| The 2021 edition of this post is out! Find it here. |

With hefty annual fees that usually can’t be waived, getting a $120K credit card is not something to be rushed into. That’s all the more so in a time when Covid-19 has negated most of their benefits, and many banks don’t seem too fussed about stepping in to help their supposedly most valuable customers.

But if you’re nonetheless thinking about taking the plunge (or renewing the one you already took), you’ll need a guide.

Welcome to the third edition of the $120K Credit Card Showdown (the 2017 and 2019 versions are linked here), where we take an in-depth look at some of the finest pieces of plastic (or metal, in most cases) money can buy.

If you just can’t wait to know the verdict…

| tl;dr: $120K Credit Card Showdown | |

|

Although it’s no doubt weaker now than a couple of years ago, the Citi Prestige continues to offer the clearest path to annual fee recovery. Between its 25,000 annual miles, unlimited lounge access (+1 guest), 4NF benefit, and Boingo Wi-Fi, cardholders should, in regular times, be able to recoup its S$535 fee. The problem is- we’re not exactly in regular times. With Covid-19 negating most of the $120K credit card benefits, would-be applicants may want to hold their fire for a while. |

…but what’s the fun in that? Dive in for the full analysis below!

What is the $120K segment?

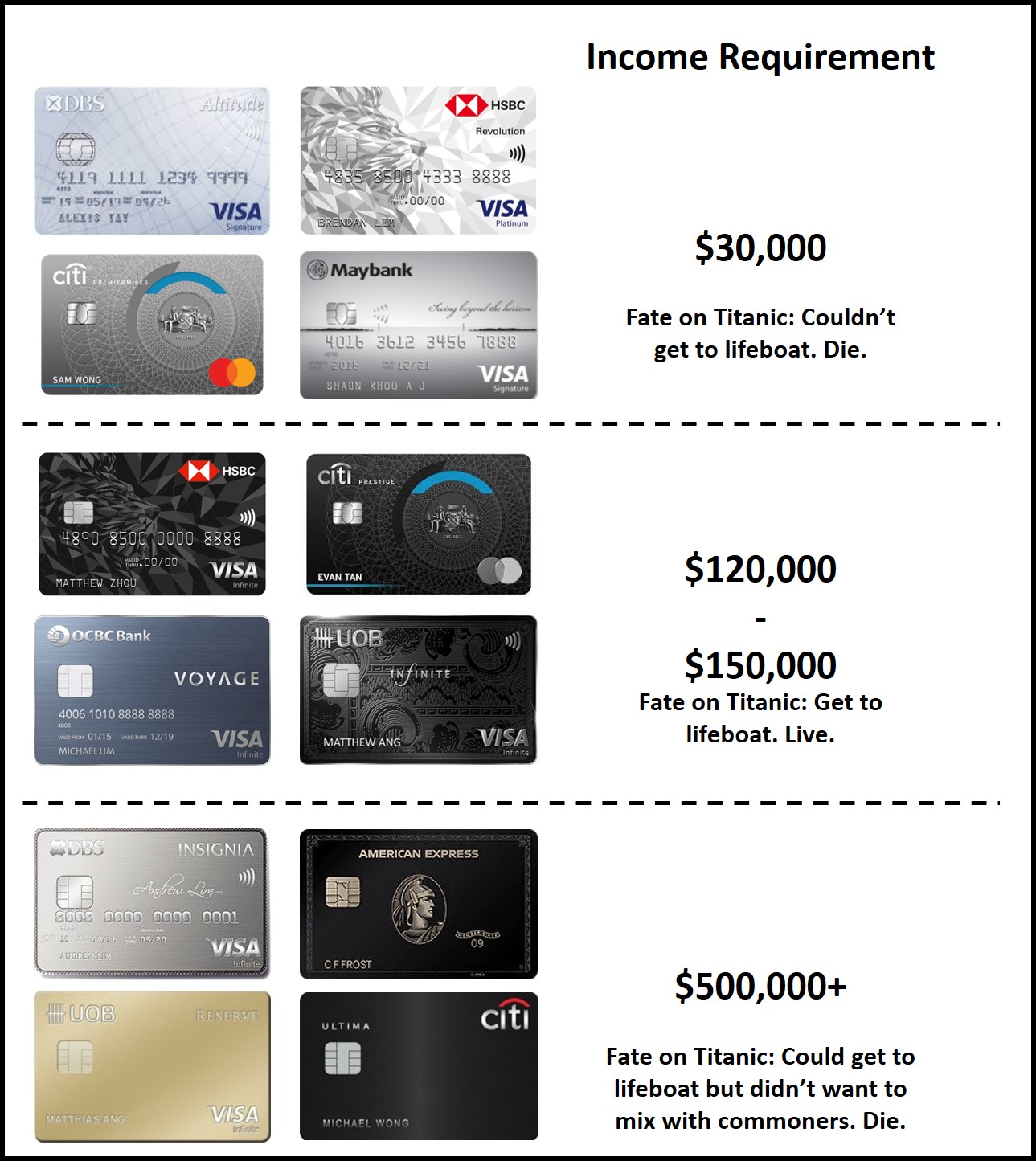

The Singapore credit card market is broadly segmented into three different tiers, which I’ve illustrated below with helpful band descriptors.

The entry level features cards like the DBS Altitude, Citi PremierMiles, and HSBC Revolution. The income requirement here is the MAS-mandated minimum of $30K. Expect nothing much in the way of benefits, other than perhaps a couple of Priority Pass lounge visits.

At the very top, you have cards like the AMEX Centurion, Citi ULTIMA, DBS Insignia, and UOB Reserve. Membership is either by invitation only, or for those with incomes in excess of $500K a year. Annual fees are in the eye watering four-digits range, but come with perks like beck-and-call concierge services, and invitations to exclusive society events.

In between those two segments you have the mass-affluent tier, otherwise known as the $120K segment. Now despite the name, income requirements here actually range between $120-150,000. These cards may not be as posh as those in the $500K segment, but still come with useful perks like unlimited lounge access and complimentary airport transfers. Some of them come with metal cardfaces too, for that extra premium feel.

The $120K candidates

Here’s the seven candidates for this year’s $120K showdown:

|

I’m going to bend the rules a little and include the SCB X Card. Yes, its income requirement is “only” S$80,000, but the annual fee of S$695.50 puts it squarely in competition with the rest of the cards here. Furthermore, it’s replaced the SCB Visa Infinite, meaning that SCB clearly sees this as their flagship product going forward.

However, there’s no room for the AMEX Platinum Charge. Its official income requirement is S$200,000, higher than the rest of this segment, and its S$1,712 annual fee is 3X the competition. This makes it almost impossible to do a fair comparison.

| ❓ Why No SCB Visa Infinite? |

| I’m going to make the perhaps controversial decision to leave out the SCB Visa Infinite. That’s because the card is no longer available for application, and if you already have one, I’d wager it’s not worth renewing. You don’t receive any miles by default for paying the subsequent year’s S$588.50 annual fee- upon appeal you *might* get 20,000 miles, but that’s still a very unattractive 2.9 cents per mile. Yes, it’s historically had one of the cheapest tax payment facilities in Singapore, but this year CardUp has launched a 1.75% tax payment promotion that allows you to enjoy cheap miles with other cards. |

What’s changed since last year?

Let’s first take a roll call of all the changes these cards have seen since the previous $120K showdown (published in April 2019).

AMEX Plat. Reserve AMEX Plat. Reserve |

|

| + Improvements | – Devaluations |

| – No more points for GrabPay top-ups, insurance, SPC -FCY fee increased to 2.95% |

|

Citi Prestige Citi Prestige |

|

| + Improvements | – Devaluations |

| -Limo spend reduced from S$20K to S$12K | -Tightening of 4th night free T&Cs -FCY fee increased to 3.25% |

HSBC Visa Infinite HSBC Visa Infinite |

|

| + Improvements | – Devaluations |

| –No more points for education, insurance, CardUp/ipaymy, utilities* | |

Maybank Visa Infinite Maybank Visa Infinite |

|

| + Improvements | – Devaluations |

| -Enrich added as points transfer partner | |

OCBC VOYAGE OCBC VOYAGE |

|

| + Improvements | – Devaluations |

| -Local mpd increased from 1.2 to 1.3^ | -FCY fee increased to 3.25% –No more guest benefit for lounge access – Overseas mpd reduced from 2.3 to 2.2^ – No more 1.6 mpd on dining^ -Limo spend increased from S$3K to S$5K^ –No more points for public hospitals and certain transport transactions^ |

SCB X Card SCB X Card |

|

| + Improvements | – Devaluations |

| New entry this year | |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

|

| + Improvements | – Devaluations |

| – No more Tower Club access – No more points for GrabPay top-ups, insurance, RentHero |

|

| *Changes take place from 1 July 2020 ^Changes take place from 1 June 2020 |

|

The OCBC VOYAGE was the only card to undergo a major revamp in the past 12 months, which technically hasn’t even come into effect yet (it will from 1 June). Changes to the other $120K cards mostly involved new rewards exclusions, or hikes in FCY fees.

There were no new launches of $120K cards during this period (unless we count the SCB X Card), which means that DBS retains the dubious honor of being the only bank in Singapore not to have an offering in this segment.

Annual Fees and Welcome Gifts

The biggest barrier to getting a $120K card for many otherwise qualified applicants is no doubt the annual fee. The cost of admission ranges between S$488 and almost S$700 a year, a significant step up from what you’d pay for an entry-level card.

| 😂 Annual fee waiver? Surely you jest |

|

The general rule is that cards in the $120K segment don’t provide annual fee waivers. There are exceptions of course:

But generally speaking, it isn’t like cards in the $30K segment where you call up the hotline, press a few buttons and get an instant fee waiver. |

Fortunately, most of the cards cushion the blow by offering miles in exchange for the annual fee. Do note that what you get upon joining may not be the same as what you get upon renewal:

- The Citi Prestige, OCBC VOYAGE, and UOB Visa Infinite Metal Card offer the same number of miles each year

- The HSBC Visa Infinite does not officially give any miles upon renewal. You’re free to call up and make noise- it’s worked for some customers

- It’s unknown as of now whether the SCB X Card will give any miles upon renewal. The SCB Visa Infinite didn’t, so I wouldn’t hold my breath

- The AMEX Platinum Reserve doesn’t offer miles with the annual fee, but you get another 2N Fraser Hospitality voucher upon renewal

First-year customers get the most bang for their buck as a HSBC Visa Infinite cardholder. Paying S$650 for 35,000 miles is the equivalent of 1.86 cents per mile, and if you’re a HSBC Premier customer, that figure drops to just 1.39 cents.

However, on a recurring basis, the Citi Prestige offers the best deal- S$535 for 25,000 miles is paying 2.14 cents each. This is still above the threshold I’m willing to pay for miles (especially given the Covid-19 situation), but relatively speaking it’s better than the rest.

Special mention for the Maybank Visa Infinite, which has no welcome (or renewal) gift, but waives the first year’s annual fee. If you’re just in this for a free Priority Pass (see below), this might be the one for you.

Miles Earning Rates

| Local | Overseas | |

AMEX Plat. Reserve AMEX Plat. Reserve |

0.69 mpd | 0.69 mpd |

Citi Prestige^ Citi Prestige^ |

1.3 mpd | 2.0 mpd |

HSBC Visa Infinite* HSBC Visa Infinite* |

1.25 mpd | 2.25 mpd |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 2.0 mpd |

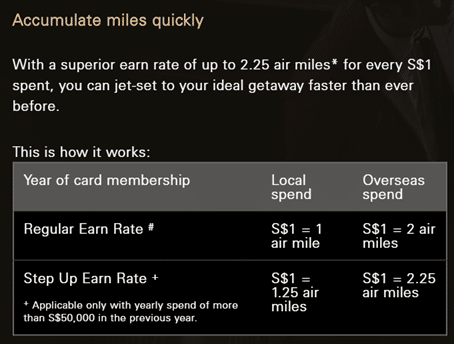

OCBC VOYAGE # OCBC VOYAGE # |

1.3 mpd |

2.2 mpd |

SCB X Card ~ SCB X Card ~ |

1.2 mpd | 2.0 mpd |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | 2.0 mpd |

| ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank *With minimum S$50K spend in previous membership year. Otherwise (or if first year), 1 mpd for local, 2 mpd for overseas #New earn rates kick in from 1 June 2020 ~Spend at least S$2,000 in a month and earn 3 mpd on overseas spending, until 30 June 2020 |

||

First things first: you don’t need a $120K card to rake in the miles. If we just look at general spending rates, the BOC Elite Miles (1.5 mpd local, 3.0 mpd overseas, at least for a little while more) and UOB PRVI Miles (1.4 mpd local, 2.4 mpd overseas) put the entire $120K segment to shame.

But anyway, assuming your spending is split 50-50 between local and overseas, the OCBC VOYAGE would offer the highest return, with 1.3 mpd on local spending and 2.2 mpd overseas. The runner up would be the UOB Visa Infinite Metal Card, with the Citi Prestige in third place.

| 💡 Point of Information |

| Technically, the OCBC VOYAGE earns VOYAGE miles. These can be converted into KrisFlyer miles at a 1:1 ratio with no admin fee, or redeemed against the cost of revenue flights. Logically speaking, this makes 1 VOYAGE Mile worth more than 1 KrisFlyer mile. We won’t go into the analysis here, but you should check out this article if you’re interested in learning more |

It’s important to remember that the OCBC VOYAGE and UOB Visa Infinite Metal Card both award points in blocks of S$5. This means you’ll earn the same number of miles on a S$10 transaction as you would S$14.99, and any transaction below S$5 earns no miles at all. The impact gets smaller as your transaction size increases, but it’s still worth taking note of when making small payments.

I’m not a fan of the HSBC Visa Infinite, because of the hoops it makes you jump through to earn its headline 1.25/2.25 mpd rates. You’d need to spend S$50,000 in the previous membership year to unlock that tier, which represents a lot of opportunity cost in terms of miles forgone by not splitting that spending across multiple cards. Fail to hit S$50,000, and you’ll earn a measly 1/2 mpd.

That’s still better than the AMEX Platinum Reserve, at the bottom of the heap with an anemic 0.69 mpd earn rate on local and overseas spending. You could earn 3.47 mpd at Platinum EXTRA partners, but these aren’t exactly what I’d call everyday merchants.

On the other hand, AMEX has the fewest rewards restrictions among all the banks in Singapore- you can earn miles on government and non-profit transactions, all kinds of hospitals, donations, and utilities bills. This makes it a good “card of last resort” when you suspect a payment might not earn points with another bank.

Points Flexibility and Expiry

Quantity of points is one thing- quality is another. All things equal, points are more valuable if they don’t expire, and can be transferred to multiple transfer partners with minimal fees.

The Citi Prestige is the winner for me. Even though it charges a S$26.75 transfer fee, it comes with non-expiring points, and with 12 partners (all of which share the same transfer ratio), has the widest variety in Singapore. It pips the SCB X Card because the X Card applies different transfer ratios depending on partner– in a worst case scenario, you’ll earn only 0.86 mpd on local spending!

| SCB X Card Partners & Effective Earn Rates if Chosen (only airlines shown) |

|||

| Loyalty Program | Transfer Ratio | Local Earn | FCY Earn |

| 2.5:1 | 1.2 | 2.0 | |

|

2.5:1 | 1.2 | 2.0 |

| 2.5:1 | 1.2 | 2.0 | |

| 2.5:1 | 1.2 | 2.0 | |

| 3:1 | 1.0 | 1.67 | |

| 3:1 | 1.0 | 1.67 | |

| 3.5:1 | 0.86 | 1.43 | |

| 3.5:1 | 0.86 | 1.43 | |

| 3.5:1 | 0.86 | 1.43 | |

There’s no space to squeeze this into the comparison table, but it’s also helpful to think about the minimum transfer block for each card. Smaller transfer blocks are preferred, because they provide flexibility and help avoid orphan points.

Special mention here goes to the OCBC VOYAGE, which allows you to transfer a minimum of just 1 mile to KrisFlyer. Add the fact that there’s no transfer fee, and you can see how it comes in useful for small top-ups.

Miles Purchase Facilities

| Buy Miles From | Limit | |

AMEX Plat. Reserve AMEX Plat. Reserve |

N/A | N/A |

Citi Prestige Citi Prestige |

1.54 cpm (PayAll) |

Rental, tax, MCST fee, education expense or electricity bill amount |

HSBC Visa Infinite HSBC Visa Infinite |

1.2 cpm (Tax Payment) |

Tax amount |

Maybank Visa Infinite Maybank Visa Infinite |

N/A | N/A |

OCBC VOYAGE OCBC VOYAGE |

1.9 cpm (VOYAGE Pay) |

None |

SCB X Card SCB X Card |

1.67 cpm (EasyBill) |

Rental, tax, insurance, education expense amount |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

2.0 cpm (Pay Anything) |

None |

Miles purchase facilities have become very much in vogue, with certain banks giving cardholders a veritable license to print miles.

There are two types of facilities:

- Those which let you buy miles provided you have a rental, tax, insurance or other bill to pay

- Those which let you buy as many miles as you want, no questions asked

OCBC VOYAGE and UOB Visa Infinite Metal Card members have access to (2), but pay a relatively higher price of 1.9-2.0 cpm. Citi Prestige, HSBC Visa Infinite and SCB X Card members can buy miles from 1.2-1.67 cpm, but the quantity is capped based on the actual amount of the bill being paid.

It’s hard to declare an out and out winner here, but I’m going to stick my neck out for the Citi Prestige. Although its 1.54 cpm figure is higher than the HSBC Visa Infinite’s 1.2 cpm, the latter assumes you’ve unlocked the 1.25 mpd rate from spending S$50,000 in the previous year. If this is your first year, or if you haven’t spent enough, your cpm becomes 1.5, a much more marginal comparison.

Furthermore, the HSBC Visa Infinite only allows you to pay income tax, while Citi PayAll users can settle income tax, rental, MCST fees, education expenses or electricity bills. Citi Prestige cardholders also get periodic offers to buy more miles, provided they hit a minimum spend- the most recent promotion offered miles at just 1.15 cents each.

Lounge Access

If it’s lounge access you’re looking for, the good news is that the majority of the $120K cards offer unlimited visits.

I’ve given this category to the Citi Prestige, but your answer may well change depending on your travel patterns.

The Citi Prestige gives you an unlimited Priority Pass with one free guest. If you travel with different people all the time, this will be useful.

The HSBC Visa Infinite has an unlimited LoungeKey with no guests, but lets you get up to five free supplementary cards, each with its own unlimited Lounge Key. This means you can get a card for your spouse, your parents, your adult kids, and bring the whole clan to the lounge for free. On the other hand, you’re unlikely to give a colleague/casual travel companion a supplementary card, which means in that scenario you can’t take them into the lounge.

Dishonorable mention goes to the SCB X Card and UOB Visa Infinite Metal Card- it’s just mind boggling they thought they could get away with 2 and 4 lounge visits on a premium card. But even that’s still better than the AMEX Platinum Reserve, however, which has no lounge access at all.

| 🛋️ Who’s the lounge provider? |

|

Remember that not all lounge access is made equal! While Priority Pass, Lounge Key, and Dragon Pass all work with roughly the same set of lounges (~1,200 worldwide), there are small differences. For example, Priority Pass gives you F&B credits at certain airport restaurants and access to amenities like sleep pods, while Dragon Pass offers access to railway lounges in China. Do note that OCBC uses Plaza Premium, which has a much smaller network of just ~70 lounges worldwide. |

Airport Limo Transfers

Complimentary limo rides to the airport are a common perk of $120K cards, and for a long time, the Citi Prestige undoubtedly had the best. By spending just S$1,500 in foreign currency per quarter, you’d unlock four rides to or from the airport.

That was extremely generous, but unfortunately Citi went and nuked it into oblivion. In April 2019, the spending requirement skyrocketed to S$20,000, which now got you just two rides. The requirement was quietly revised down to S$12,000 in February 2020, but it’s still a shadow of its former self.

I’d say the new winner is the HSBC Visa Infinite. Just paying the annual fee gets you two complimentary airport transfers (four if you’re a HSBC Premier customer), and you can subsequently unlock additional rides with just $2,000 spending.

| 🚗 Accumulate your limo rides |

|

With the ongoing travel bans, airport limo rides are kind of useless at the moment. OCBC is unique among the banks in allowing cardholders to accumulate rides throughout 2020, instead of requiring them to be used straight away. Any rides earned now could therefore be used in Q4 2020 or Q1 2021, assuming travel opens up by then. A pity that OCBC is raising the limo spending requirement to S$5,000 though. |

Private Club Access

The UOB Visa Infinite Metal Card lost its Tower Club access privileges last year, leaving the AMEX Platinum Reserve as the only card offering private club access.

AMEX Platinum Reserve cardholders (both principal and supplementary) can access the Tower Club’s dining and conference facilities by making bookings through the AMEX concierge. This is limited to five cardmembers per day, and all expenses incur a further 10% surcharge.

Although the Straits Bar is a nice place to have a drink, I find the overall Tower Club experience to be a bit stuffy and overrated. It’s certainly not a decisive factor for choosing a $120K card.

Dining Perks

| Dining Perks | |

AMEX Plat. Reserve AMEX Plat. Reserve |

|

Citi Prestige Citi Prestige |

|

HSBC Visa Infinite HSBC Visa Infinite |

|

Maybank Visa Infinite Maybank Visa Infinite |

|

OCBC VOYAGE OCBC VOYAGE |

|

SCB X Card SCB X Card |

|

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

|

| *4 free rides for HSBC Premier |

|

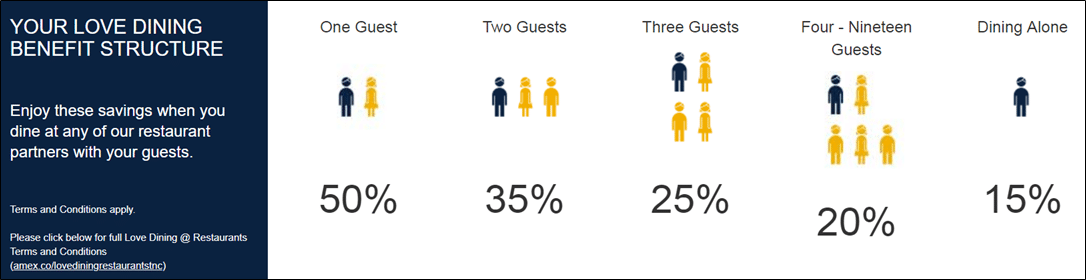

The AMEX Platinum Reserve may not have a lot going for it, but it does offer a solid dining proposition. Cardholders enjoy Love Dining benefits, which offers up to 50% off at a wide variety of hotels and high-end restaurants around Singapore.

In addition to this, there’s also Chillax, which gives 1-for-1 drinks at selected bars islandwide. The full list of partners can be found below:

|

|

| Hotels | Restaurants |

|

|

|

|

|

|

Cardholders also receive a S$100 Tower Club dining voucher and some assorted group discounts at the Marriott Tangs Plaza, which can help offset the annual fee.

| 💡 You don’t actually need the AMEX Platinum Reserve to enjoy Love Dining and Chillax. It’s also available on the entry-level AMEX Platinum Credit Card (AF: S$321) |

None of the other cards really shine here, because their offers are either sporadic (Citi Prestige special dinners are usually once a month, and often oversubscribed), or could be had for free (HSBC Visa Infinite gets a complimentary Entertainer, but so do other HSBC cards with fee waivers).

Don’t get too excited about the Gourmet Collection membership that comes with the UOB Visa Infinite Metal Card. UOB markets the benefit as “worth S$388 per annum”, which makes you think they’re offering the Tier 1 membership. This, if purchased separately, would come with S$200 of dining vouchers.

However, cardmembers have confirmed that you don’t get any of those vouchers- just the card, which offers 25% off the bill at participating restaurants and bars, and 15% off rooms. What’s more, the benefit only applies in the first year. If you want to renew it, you’ll need to pay S$68 (or spend at least S$1,000 at participating IHG hotels)

Unique Perks

In addition to the benefits above, some $120K cards have unique perks which are well worth discussing.

Citi Prestige: Fourth Night Free

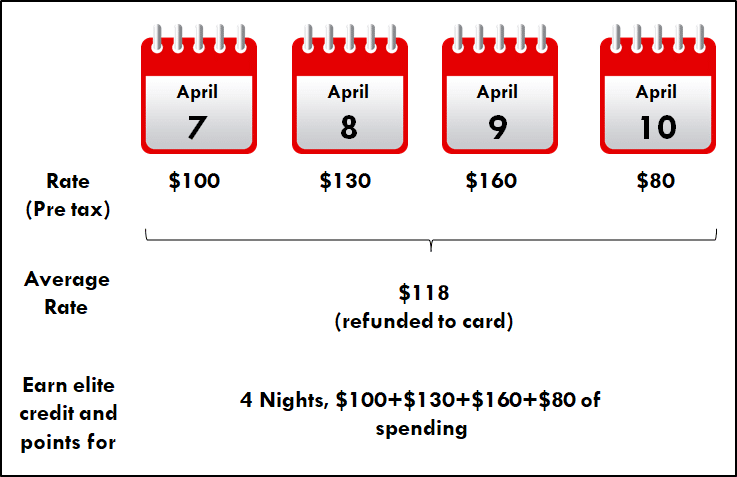

The 4th Night Free (4NF) benefit is no doubt one of the best perks of the Citi Prestige card. Used judiciously, cardholders can recover great chunks of their annual fee.

With 4NF, cardholders can request the Prestige concierge to book any publicly-available hotel rate and receive four nights for the cost of three. The average nightly pre-tax room rate is calculated and refunded to the card. This refund is done on the back end, so you’ll still earn hotel points and elite credit (where applicable) for four night’s worth of spending.

Unfortunately, Citi has been tightening the screws on 4NF, and in March added some additional exclusions in terms of eligible rates and types of rooms covered. The benefit can no longer be used for suites or villas, nor can it be used on any half-board stays.

That said, there’s no cap on the maximum uses (yet- the US version is now capped at two free stays per year), and a potential deal-maker if your travel schedule allows you to use it.

Citi Prestige: Boingo Wi-Fi

This isn’t a Citi Prestige specific offer as such, but by virtue of its World Elite Mastercard badge, cardholders can get complimentary Boingo Wi-Fi that offers internet access at millions of hotspots worldwide. More importantly, it also gives free Wi-Fi on certain airlines, including Singapore Airlines aircraft equipped with Panasonic Avionics systems.

Some handy savings here, if you fly a lot.

HSBC Visa Infinite: Priority Immigration

HSBC Visa Infinite cardholders who spend $2,000 in a month receive complimentary fast-track immigration service at selected airports for themselves and a guest. Just like the limo benefit, two complimentary redemptions are provided each year with no minimum spend (four for HSBC Premier customers).

Depending on the airport, the fast-track immigration may also include meet and assist services, which escort you to/from the airplane.

Maybank Visa Infinite: JetQuay access

JetQuay is a private terminal at Changi for CIPs (commercially-important people). You get dropped off at a private driveway, your check-in is handled by the terminal staff while you relax in the lounge, and the only time you mingle with the unwashed masses is en route to your flight in an electric buggy.

All that sounds great, but I’ve tried it and I can tell you it’s underwhelming. The JetQuay facility is dated, the food selection poor, and although service is great, there’s no reason why you should choose it over an airport lounge.

The full-fledged JetQuay Quayside experience normally costs ~S$428, but Maybank Visa Infinite cardholders can get it for free. Spending S$3,000 a month unlocks a choice of either two limo rides or a single JetQuay use.

Take the limo rides.

OCBC VOYAGE: Redeem miles for any flight

A unique feature of OCBC VOYAGE is that VOYAGE miles can be used to redeem any flight in any cabin on any airline, provided you have enough of them. When used this way, your VOYAGE miles are used to offset the revenue cost of the flight.

The value of a VOYAGE mile depends on which zone you’re flying to. I’ve written some extensive analysis on the topic here so I won’t get into it again, suffice to say it’s a useful feature to have.

Summing it up: Which $120K card?

Here’s where it gets tricky. I don’t believe it’s worth getting a $120K card right now. As you can see, their benefits are heavily focused on travel and lifestyle, and with the current border closures and Circuit Breaker measures, you won’t get much out of them. There’s little point in shelling out the annual fee for benefits you can’t use, and I’d wait until things get a bit more sane before dipping my toes in.

That said, assuming we were in a “normal” time, I think the Citi Prestige would come out on top. Not because I’m particularly enamored by how its benefits have been chipped away over the past couple of years, but because it presents the clearest path to annual fee recovery.

The 25,000 miles are already worth a fair bit, and assuming you use the 4NF benefit three to four times a year, regularly visit airport lounges and use inflight Wi-Fi, it’s not difficult to recoup your S$535. The wide variety of transfer partners and non-expiring points is just icing on the cake.

No doubt the Citi Prestige is now weaker than it was a couple of years ago. So it says a lot about the competition that the OCBC VOYAGE and HSBC Visa Infinite are a distant tie for second.

The OCBC VOYAGE offers competitive miles earning rates (even after its upcoming changes), but I dislike the fact that its lounge access is so limited (Plaza Premium’s footprint is relatively tiny), with no more guesting privileges. VOYAGE miles may be an interesting tool, but the card otherwise lacks a real X factor.

Similarly, I like that the HSBC Visa Infinite has one of the easiest limo requirements, and priority immigration can be a lifesaver in some countries. If you max out the five supplementary cards, you could have six unlimited Lounge Keys. That may be worth the price of admission for some, but I’d have difficulty justifying the second year’s annual fee without any miles in return; not to mention its mediocre earn rate (unless you’re able to hit S$50,000 spending).

The rest of the cards are then a mish mash of bright spots here (effectively free lounge visits with the Maybank Visa Infinite and its first year free) and absolute rubbish there (two lounge visits with the SCB X Card). Any kind of ranking here would just be false precision.

Conclusion

Do you need a $120K card? No, in the same way you don’t need a whole lot of other things.

For those who travel a lot or who enjoy a higher level of personalized service (although that’s debatable- I’ve heard many complaints from $120K cardholders!), such a card may be a worthwhile companion.

For those who just want to earn the greatest number of miles with the lowest possible spending, you’d be much happier off with the basic credit cards I lay out in the Miles Game Starter Pack.

Value is of course subjective, so it’s important you take a long hard look at the features of each $120K card and come to a decision that makes sense for you.

Which $120K card is your choice? Or are $30K cards good enough for you?

Yeah, I am going to call HSBC tmr to cancel my VI card before it gets renewed next month, but would like to see anyway, how they will retain their premier customer~

The only premium card I have decided to stay with is my AMEX platinum charge, it’s not worthy the annual fee for now, well, AMEX just has got my heart.

Great analysis Aaron! I’ve been waiting for a refreshed review of the 120k segment, and this is just excellent. I would’ve liked to see the OCBC Premier Voyage get a mention, and what’s interesting is that the Premier Voyage is available at 30k income too. For me, I think the 1.6 mpd earn rate of the Premier Voyage knocks all of these cards’ earn rates out of the park, including the cards PRVI Miles and BOC Elite Miles. On top of the superior earn rate, VOYAGE miles can be used for revenue fares, have no transfer fee, and like you… Read more »

glad you found it useful! Actually, I was considering adding the VOYAGE variants, but once I add the Premier VOYAGE, the question becomes why not add SCB Priority Banking Visa Infinite, or DBS Treasures AMEX, and then things get a bit more complicated. but yes, the premier voyage no doubt has better earning rates. at the same time, the question is whether they’re good enough to justify paying $488- the only other difference per my understanding is that you have tower club access, otherwise it’s a vanilla voyage card. I don’t see the path to recovering the annual fee as… Read more »

Premier Voyage also has no annual fees, I didn’t get any joining annual fee and it’s easy to get your RM to waive if you don’t meet 30K spending. It was great to begin with, only thing that bothered me was the no pay wave function and you had to use your phone for MRT rides. But it is just going downhill. Now with S$5 chunks, its useless for MRT rides. Limo spending is increased and what I found to be the worst was the removal of guest+1 for lounges. Had to get a supplementary card for the wife when… Read more »

AF for Premier Voyage is waived if you hit $30K annual spend, so I’m keeping it as my general spend card.

You bring a very good point Aaron! When I was looking for a general spend card, I’d looked at 1.6 mpd cards, starting with the UOB Reserve. I found the OCBC Premier Voyage superior to that in earn rates considering $488 is a drop in the pond compared to over $3000+ for the UOB. On top of that, Voyage Miles are worth more than KF Miles, so at the same earn rate, the Voyage was an obvious choice! As for justifying the $488 annual fee, this depends on the individual’s spending. As the AF is waived if you spend above… Read more »

The HSBC VI actually allows up to 5 supplementary card holders at no extra charge, and all cardholders get unlimited lounge access. I have 2 children above 18, so with my spouse it’s useful as 4 of us can use it anytime even when we are not travelling together.

Did I understand you correctly? All along I had the understanding that only the first supp cardholder gets an unlimited lounge pass. You’re saying that you can get up to five extra unlimited lounge passes, for the same annual fee?

did some digging and yes, you’re right. that is incredible, and well worth an update.

Yes their website says supplementary cards (up to five) are free for life , and the terms and conditions provide that any supplementary cardholder only needs to present the credit card.

If DBS allow the current Treasures Black Amex card to be opened to those with $120k or $150k with current benefits and earn rates, it would make the $120k segment interesting!

DBS Treasures Black Card isn’t all that exciting, it’s basically a DBS Altitude with a slightly better FCY earn rate. I wouldn’t pay too much attention to it.

If I had $200K I’d rather use it to start a Priority Banking relationship with OCBC and get the Premier VOYAGE. The earn rate is highest for gen spend and VOYAGE miles are worth more than other points and currencies.

25K miles at 1.5 cents is $375. Add free Priority Pass with Guest easily worth $50. 4NF just once should make up the balance $110. And despite the downgrade, 4NF still works with almost any hotel up to club rooms (except clubmed, apartments,suites, villas, farm stays even backpacker hostels in Africa but that was unbelievable before!). Icing is 4Hands or a musical once or twice a year. 7 course dinner for 2 with 6 glasses of wine each at $110/pax at the Lighthouse, Esquina, Stellar 1-Altitude etc is a at least 50% off….. no? If nothing else, your partner will… Read more »

Is the citi prestige card ideal for hospital payments? I think most cards don’t give bonus points for hospital so its category will be under general spending?

i also wondering if i really need 120k card, haven’t decide should i cancel my prestige card

i cant help but feel like theres a sense of hatred towards the 1% after reading the helpful band descriptors

OCBC Voyage $5 spending block is a devaluation to me

Thanks for the great in depth (as usual) comparison!

I’ll pay to renew my Citi Prestige partly because I have a lot of points which I don’t want to convert yet.

I intend to meet the minimum spend on my OCBC Voyage to get the AF waived.

Surprised you didn’t mention that Amex plat Reserve also comes with a monthly travel magazine and a free cake on your birthday. Although not game changing benefits, but it does add some personal touch that is hard to find nowadays.

Oh I didn’t know there is a travel magazine. How do I receive it?

Slight correction to the SCB Visa Infinite part – the card’s still available for application, and it’s still on their website

the scb visa infinite is not available for application anymore, although it’s still on the website.

One correction to make to the X Card: SCB’s X Card now offers 30k miles upon payment of the S$695.50 annual fee (which works out to be 2.3 cents).

I love your new website design – it’s so easy to navigate now! Keep up the good work Aaron!

scb x card offers 30,000 miles in the first year; it’s unknown if they will offer this for the second year onwards simply because no one’s held the card for more than 1 year at this point in time.

They’ve updated their website to address this…

Oh dang I misread the T&Cs… ignore the above

Not well-explained on Citi website which uses % for illustration. Simpler explanation at mainlymiles.

The Prestige earn ratio is up to 1.42 mpd local and 2.12 mpd overseas for Citigold.

Without Citigold it’s 1.32/2.02 to 1.36/2.06 depending on how long you have had a Citi card or bank account.

For new cardholders with no Citi bank accounts, it’s 1.32/2.02 for the first 5 years.

Small but significant since we’re comparing cards. Readers here probably self-select as maxigain people as well (or at least till 6 months ago) and that’s a Citi account.

thanks! I’ve written a piece on how the citi relationship bonus works here

https://milelion.com/2019/08/24/how-does-the-citi-prestiges-relationship-bonus-work/

[…] S$80,000, the SCB X Card’s annual fee and positioning puts it squarely in competition with the so-called $120K segment, alongside heavyweights like the Citi Prestige and OCBC […]

If compared between OCBC Premiem Banking Voyage and Citi Prestige, would you say Citibank still has the upper hand?

yeah i’d say so, especially with their recent 1 for 1 staycation offers, plus the fact that voyage recently devalued with the $5 blocks and slight cut to FCY earn rates

Hi, I’m from indonesia. is it when we use the limo we tip the driver? if so, how much? thank you

it’s not common practice in SG, but always appreciated!

Thanks a lot! Just moved to Singapore and that was exactly the article I was looking for. Indeed, with no travel in in sight for the foreseeable futures, this card segment is probably not worth it at the moment!

2021 showdown on the horizon? Multiple AF coming up shortly so looking forward to this as a major data point.

oh yes, stay tuned.

Can’t wait for the 2021

here you go: https://milelion.com/2021/05/25/2021-edition-the-120k-credit-card-showdown/