Insurance premiums are a category that banks have progressively excluded over the years. When I first started writing this blog a decade ago, you could easily earn up to 4 mpd on premium payments. Today, you’d be lucky to earn anything!

The good news, if you dare to call it that, is that earning miles on insurance premiums isn’t impossible. The scope is just very limited, or you’ll need to pay a fee for the privilege.

What MCC does insurance code as?

Insurance transactions code under two main MCCs:

- 5960: Direct Marketing Insurance Services

- 6300: Insurance Sales, Underwriting and Premiums

In case you’re uncertain about the MCC, there are three ways of looking it up before making a transaction:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Merchants assigned insurance-related MCCs typically pay a below-average processing fee, and banks are therefore less inclined to offer rewards on such transactions.

Which credit cards earn rewards for insurance?

As mentioned earlier, the vast majority of banks now exclude insurance transactions from earning points. Here’s a snapshot of each bank’s policy:

| Issuer | Awards Points for Insurance? |

| ✓1 | |

| ✕ |

|

| ✕ | |

|

✓2 |

| ✕ | |

| ✕ | |

| ✓3 |

|

| ✕ | |

| ✓4 | |

|

✓5 |

| 1. Only for insurance products purchased through American Express authorised channels (e.g. Chubb) 2. Capped at 100 miles per month 3. Only for Maybank Visa Infinite and Maybank Horizon Visa Signature 4. Only for SC Prudential Platinum & SC Prudential Visa Signature 5. Only for UOB KrisFlyer Debit Card |

|

Don’t get too excited if you see a green tick in the table above— one glance at the footnotes, and you’ll understand just how limited the scope for earning miles on insurance premiums is!

American Express cards

| Card | Earn Rate for Insurance |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit CardApply |

1.3 mpd |

AMEX PPS Credit Card AMEX PPS Credit CardApply |

1.3 mpd |

AMEX HighFlyer Card AMEX HighFlyer CardApply |

1.2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

1.1 mpd |

AMEX Centurion AMEX CenturionApply |

0.98 mpd |

AMEX Platinum Charge AMEX Platinum ChargeApply |

0.78 mpd |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

0.69 mpd |

AMEX Platinum Credit Card AMEX Platinum Credit CardApply |

0.69 mpd |

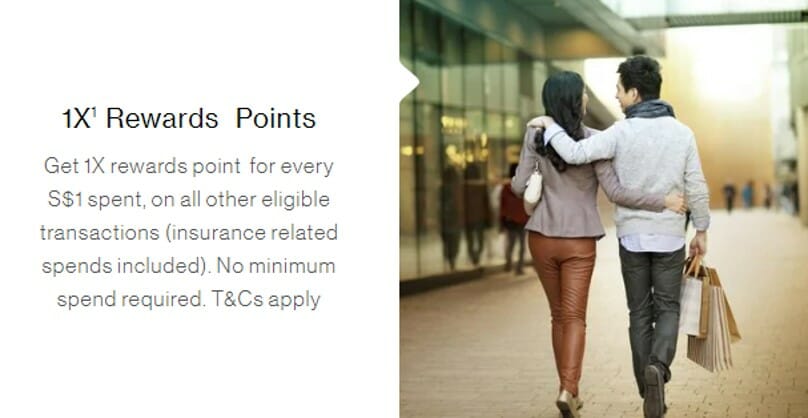

While American Express cards generally exclude rewards for insurance payments, there is one exception: buying insurance from the AMEX x Chubb portal.

Earn your usual card rewards, including Membership Rewards® points, KrisFlyer miles and cashback when you sign up for Amex Insurance plan(s) with your American Express® Card.

-American Express

The types of insurance you can purchase on this portal are limited to:

- Travel insurance

- Hospital cash insurance

- Surgical cash insurance

- Gadget insurance

- Personal accident insurance (I don’t see a way of getting a quote for this online, so you might have to call in to ask)

Chocolate Visa Card

|

| Apply |

| No annual fee or minimum income requirement |

The Chocolate Visa Card earns 1 Max Mile per S$1 on the first S$1,000 spent per calendar month, after which the rate reduces to 0.4 Max Miles per S$1.

This includes insurance premiums, but here’s the catch: Chocolate has a cap of 100 Max Miles per month on so-called “bill payments”, which include insurance premiums plus the following categories:

| MCC | Category |

| MCC 4900–4999 |

Utilities |

| MCC 6300–6399 |

Insurance |

| MCC 6513, 6531 |

Real Estate and Property Management |

| MCC 7311–7399 |

Business Services |

| MCC 8011–8099 |

Medical Services, Health Practitioners, Hospitals, Dentists |

| MCC 9311–9399 |

Government Services |

| For the avoidance of doubt, the 100 miles cap is shared among all categories | |

To get the Chocolate Visa, you’ll need to download the Chocolate Finance app and open a Chocolate Finance account.

|

| 👍 200 Max Miles joining bonus |

| Sign up for a Heymax account and get up to 200 Max Miles as a welcome bonus |

| 200 bonus Max Miles |

Once that’s done, you can create a virtual Chocolate Visa Card immediately. After that, you need to pair the card with Heymax under the Your Cards > Add Card menu. A test transaction will be charged and later refunded.

Maybank Visa Infinite & Maybank Horizon Visa Signature

| Card |

Earn Rate for Insurance |

|

| SGD | FCY | |

Maybank Visa Infinite Maybank Visa InfiniteApply |

1.2 mpd |

3.2 mpd Min. S$4K / c. mth 2 mpd |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

0.16 mpd | 2.8 mpd Min. S$800 / c. mth 1.2 mpd |

While the T&Cs of the Maybank TREATS programme excludes insurance payments, an explicit exception is carved out for the Maybank Visa Infinite and Maybank Horizon Visa Signature.

|

For avoidance of doubts (sic), the exclusion (relating to payments to insurance companies) under clause 2.2(e) of the Maybank Year-long TREATS Points Rewards Programme General Terms and Conditions does not apply to this 3X TREATS Points Programme, i.e. payments to insurance companies (up to S$3,000 per calendar month) may be counted for the awarding of 3X TREATS Points herein. -Maybank Visa Infinite T&Cs |

|

For local retail transactions charged to the Card on Insurance, Medical, Education, Rentals (e.g. RentHero) and Professional Services (e.g. CardUp) (“Spend on Selected Categories”) -Maybank Horizon Visa Signature |

The Maybank Visa Infinite earns 1.2 mpd (SGD) or 2 mpd (FCY) on all spending, including up to S$3,000 of insurance premiums per calendar month. If the total monthly spending across all transactions exceeds S$4,000, the FCY earn rate is enhanced to 3.2 mpd.

However, spending on insurance premiums does not count towards the S$3,000 minimum spend required to qualify for airport limo transfers or gym and pool day passes.

The Maybank Horizon Visa Signature will earn 0.16 mpd (SGD) or 1.2 mpd (FCY) on insurance premiums. If the total monthly spending across all transactions exceeds S$800, the FCY earn rate is enhanced to 2.8 mpd.

However, insurance premiums (along with other selected categories such as medical, education, rentals and professional services) are capped at 480 miles per month. This cap only applies to transactions made in SGD; FCY spending would not be subject to a cap.

Spending on insurance premiums will also not count towards:

- the S$800 minimum monthly spend required to earn 2.8 mpd on FCY spend (uncapped) and 2.8 mpd on air tickets (capped at S$10,000 per calendar month)

- the S$1,000 single-transaction spend required to earn a complimentary Plaza Premium Lounge pass valid at selected airports

Standard Chartered Prudential Cards

| Card | Earn Rate for Insurance |

SC Prudential Platinum SC Prudential PlatinumApply |

0.29 mpd |

SC Prudential Visa Signature SC Prudential Visa SignatureApply |

0.43 mpd |

The little-known Standard Chartered Prudential Platinum and Standard Chartered Prudential Visa Signature explicitly state that rewards points are awarded on insurance premiums— even if they’re not from Prudential.

The earn rate is 1X points per S$1 for Prudential Platinum Cardholders, and 1.5X points per S$1 for Prudential Visa Signature Cardholders. This works out to 0.29 mpd and 0.43 mpd respectively.

Do note that the Prudential Visa Signature is only available to members of Ascend by Prudential.

KrisFlyer UOB Debit Card

| Card | Earn Rate for Insurance |

KrisFlyer UOB Debit Card KrisFlyer UOB Debit CardApply |

0.4 mpd + Miles from KrisFlyer UOB account |

The KrisFlyer UOB Credit Card does not earn miles on insurance, but this exclusion does not apply to the KrisFlyer UOB Debit Card, which will earn at least 0.4 mpd on premium payments.

Why “at least”? Because accountholders can earn bonus miles for putting money in the KrisFlyer UOB Account and spending on their debit card. The current structure gives a bonus 5 or 6 mpd to anyone who keeps a minimum monthly average balance (MAB) of S$1,000 in the account.

| MAB | Monthly Cap (5% of MAB) |

Card Spending Cap | |

| No Salary Credit (5 mpd) |

With Salary Credit (6 mpd) |

||

| S$1,000 | 50 miles | S$10 | S$8.33 |

| S$10,000 | 500 miles | S$100 | S$83.33 |

| S$20,000 | 1,000 miles | S$200 | S$166.67 |

| S$50,000 | 2,500 miles | S$500 | S$416.67 |

| S$100,000 | 5,000 miles | S$1,000 | S$833.33 |

The catch is that you receive a paltry 0.05% p.a. interest, and the bonus miles are capped at 5% of the MAB. For example, someone who put the bare minimum S$1,000 in the account would be limited to earning just 50 bonus miles per month.

So unless you’re willing to forgo a significant amount of interest, it’s probably better to forget the KrisFlyer UOB Account altogether and just take the earn rate as 0.4 mpd.

Bill payment services

If you’re willing to pay a fee in exchange for earning miles on insurance premiums, then bill payment platforms like CardUp, Citi PayAll and SC EasyBill are all potential options.

| Provider | Fee |

|

2.25% 1.79% fee for first payment of up to S$5K with code MILELION |

| 2.6% | |

|

1.9% |

Whether it’s “worth it” to buy miles at this price all boils down to how much you value a mile, but to provide some illustrations:

- An SC Beyond Cardholder with Priority Banking/Priority Private status could pay insurance premiums via SC EasyBill with a 1.9% fee and earn 2 mpd, equivalent to 0.95 cents per mile

- A DBS Vantage Cardholder could pay insurance premiums via CardUp with a 1.85% fee (for recurring payments) and earn 1.5 mpd, equivalent to 1.21 cents per mile

- A Citi Prestige Cardholder could pay insurance premiums via Citi PayAll with a 2.1% fee (temporarily reduced with the current promotion) and earn 1.3 mpd, equivalent to 1.62 cents per mile

The gold standard is of course to earn miles for free, though if banks keep cracking down, this may be the only option left.

Workarounds

While banks may not be fond of rewarding insurance purchases, there are ways of “disguising” the transactions. The key is to find an insurance premium sold by a company whose main line of business is not insurance.

Klook

Klook usually sells tours and attraction tickets, but they also sell a travel insurance product known as Klook Protect. These policies are underwritten by companies like AIG, AXA, FWD and Zurich, basically a white label kind of product.

Buying Klook Protect codes the same as any other Klook transaction: MCC 4722 Travel Agencies and Tour Operators. You can use the following cards to earn up to 4 mpd.

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1K per calendar month Review |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd |

Min S$500 per c. month, max S$1K per c. month Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$750 per calendar month. Must choose Travel as bonus category Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per calendar month. Must choose Travel as bonus category Review |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd | No cap Review |

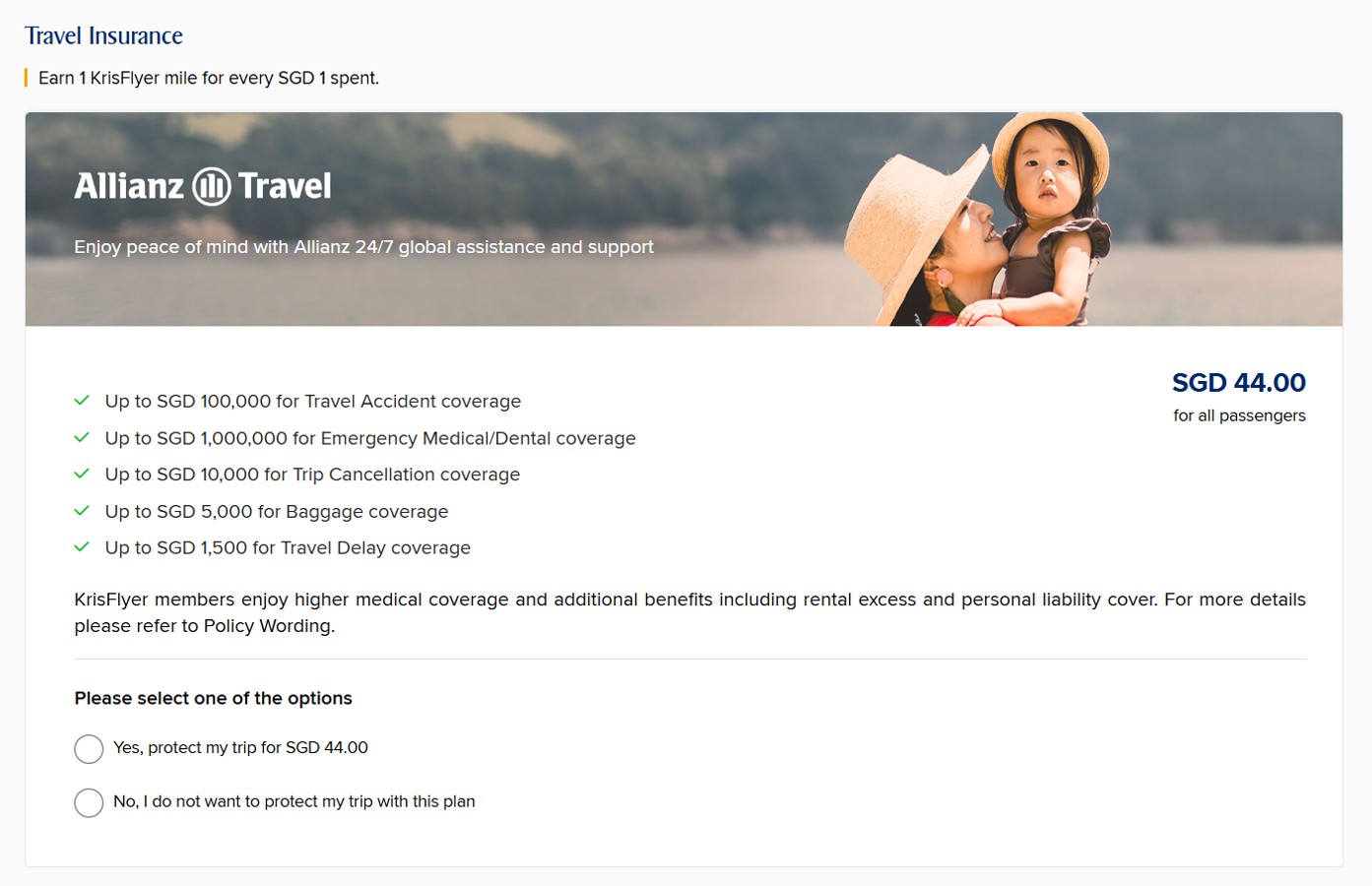

Singapore Airlines & Scoot

When you’re booking a Singapore Airlines or Scoot air ticket, you’ll usually be offered the opportunity to include travel insurance.

If you opt in, the transaction will code under the airlines’ MCC, enabling you to earn 4 mpd with whatever card you’d normally use for airfares.

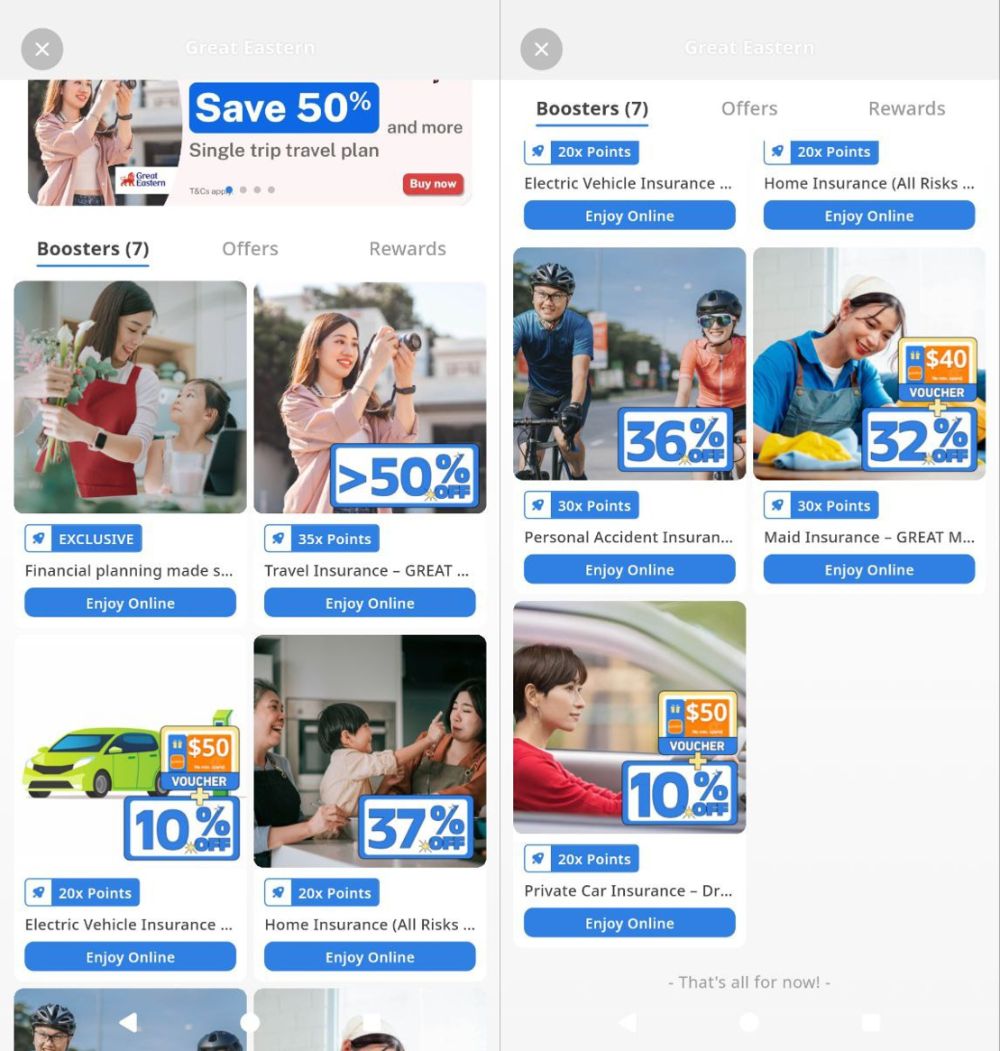

Great Eastern

The yuu Rewards Club app allows members to earn yuu Points when purchasing selected Great Eastern insurance policies (tap on Brands > Great Eastern).

At the time of writing, it’s possible to earn up to 35 yuu Points per S$1 on policies, equivalent to 9.7 mpd.

| Policy | Reward |

| Travel insurance | 35 yuu Points per S$1 9.7 mpd |

| Maid insurance | 30 yuu Points per S$1 8.3 mpd |

| Personal accident insurance | 30 yuu Points per S$1 8.3 mpd |

| EV insurance | 20 yuu Points per S$1 5.6 mpd |

| Home insurance | 20 yuu Points per S$1 5.6 mpd |

| Private car insurance | 20 yuu Points per S$1 5.6 mpd |

You must complete the purchase via the yuu Rewards Club app to be eligible. To be clear, the points will come from the yuu app, not your credit card- paying with the DBS yuu Card won’t earn anything extra as insurance premiums are a general exclusion.

Conclusion

Earning miles on insurance premiums gets tougher and tougher each year, but there are still a handful of options.

The Maybank Visa Infinite is probably the best all-round solution, but with a minimum income requirement of S$150,000 and an annual fee of S$654 (waived for the first year), it won’t be an option for everyone.

Alternatively, you can consider restricting yourself to policies from Chubb (and paying with AMEX) or Great Eastern (and earning yuu Points), but these may or may not offer the best coverage for your needs. I think it’d be quite silly to base your coverage decisions on the ability to earn points alone!

For everything else, there’s always CardUp and Citi PayAll, though the cost per mile will vary depending on which card you hold and the ongoing promotions.

Are there any other ways you know of earning points on insurance premiums?

Hi Aaron,

How do you make payment for Tokio Marine premiums via Visa/MC? Is there a link that you can share? Thanks

when i got my life insurance plan, my agent gave me a form to fill up. can’t remember if it was first premium only or recurring.

Thanks. I was figuring out how to use Visa/MC to pay for my recurring TM premiums.

I was thinking to use HSBC Revolution card to pay online. However axs-estation do not have HSBC credit card as a selection.

I believe it is only for the first premium only. I also ask this qns before from my TM agent.

Does GPMC work with CardUp and IPM?

Yes it doss

CardUp / iPayMY transactions on GrabPay MasterCard, will not earn any Grab Reward Points.

U can only get the 1.5% / 1.7% Cashback via TrueCashback Amex or UOB Absolute Amex Top-Up to GPMC Wallet.

Great article about IP update, looking forward updated article for tuition fee for poor parents.

unfortunately, very few cards left for education payments too!

Great Eastern does not accept Grabpay MC card to pay for my 1st year life insurance. but when i switch to bank MC card, it goes through.

Same here, second this comment.

Hi Aaron,

Just sharing, I actually emailed to DBS & Citi to check if they award points/miles if insurance payment made through CardUp Platform but their reply was that no points/miles will be awarded.

In the end, I tried using SCB EasyBill function @ 1.9% fee instead.

thanks derek. unfortunately the CSOs have misinformed you. payments made via cardup using citi/dbs cards continue to earn points as per normal, nothing has changed.

CardUp / iPayMY transations does NOT earn points/reward on ALL Citi/DBS cards.

eg.

DBS Live Fresh / SAFRA Cards do NOT earn cashback on CardUp / iPayMY transactions.

DBS Altitude Cards do earn DBS Points on CardUp / iPayMY transactions.

I’m not very sure which Citi cards have cashback/Citi$ for CardUp/iPayMY transactions, as CardUp specifically disallow Citi cards for some payments (eg. Mortgage Loans, etc).

Aaron’s reply is one year ago and at that time is true.

this is also in the context of miles cards. if the qn is: do dbs altitude/citi premiermiles earn miles on cardup, the answer is yes. can’t speak to the cashback cards cause i’m less familiar with that.

citibank and amex cannot be used for mortgage payments or loan payments.

more details: https://carduphelp.zendesk.com/hc/en-us/articles/360024526894-Will-my-spend-on-CardUp-earn-rewards-on-my-credit-card-

Hi Aaron, may I know if the new CitiRewards Mastercard earns the same as the visa? Will I still get 4mpd if I top up grabpay?

Earn the same BUT Visa and Master is different. You won’t get anything on top up grappay with a mastercard!

Hi Aaron,

Thanks for this summary.

I did some google search, and actually I found seems that Amex True Cash Back currently still considers the insurance premium as the eligible transaction. (amex.co/SGexclusions)

Could you please confirm or did I miss something?

If it’s true, given that I might have 10000 SGD pending premium in next few weeks, should I go for this Amex True Cash Back credit card?

Thanks

Refer to:

amex.co/SGexclusions

https://www.americanexpress.com/content/dam/amex/sg/campaigns/pdfs/true-cashback-card.pdf

https://www.americanexpress.com/content/dam/amex/sg/benefits/SGexclusionsjan20.pdf

https://www.maybank2u.com.sg/iwov-resources/sg/pdf/cards/horizon-benefits-privilege-tnc.pdf

Please see the terms and condition on Maybank Horizon card. Insurance premium is excluded. Not sure whether it is a recent change. Can the admin please verify

read this: https://www.maybank2u.com.sg/iwov-resources/sg/pdf/cards/terms_and_conditions.pdf

more recent.

So from this, I gather that T Points are awarded for the VI card, up to $3000 per calendar month?

maybank visa infinite still awards subject to the cap in t&c

Hi Aaron, would you mind to share your wisdom on the following scenario?

May I know, will it have 3000 per month cap and will it follow FCY treat point track, i.e., 5x points?

OCBC Great Eastern Cashflo have recently changed their terms. no more points i believe and they charge you for amortizing payments

Fyi, I paid for insurance (first time sign up premiums) using Horizon recently, checked statements for next 2 months and zero Treat Points to date.

You can use Horizon to top up Grabpay card to get points and use it to pay for insurance directly or through Cardup. Which insurer?

Amex cards (KF, Platinum and Capitacard) are still giving rewards for GrabPay topup as well, and there is an ongoing campaign. Does that not count?

I guess the Amex offer is targeted and for a limited time, therefore not included as a solution in the long term.

campaign until 10 May 2021 and quota by $5k. but with $5k , at least it is a solution for most of people for this year insurance.

Yup! If you managed to register for the then by all means go ahead

Counts, but the registration cap already exhausted.

Interestingly enough, the Prudential cards also have 10X for foreign currency transactions so you could potentially use this card as a substitute for the Rewards+, or as an alternative once you max out the cap on Rewards+.

yeah, I just realised that while I was reading through T&C. this pooling thing opens up a lot of possibilities…

Hi Aaron,

How about Cigna international insurance plan? Since it charges in USD, is it considered an overseas spendings and would go well with SC Rewards+ or PRVI?

MCC overrides currency. if it codes as insurance and the T&Cs disallow, you will not earn points even if it’s FCY

Manulife not included?

hi aaron. grabpay mastercard cannot be used to pay insurance bill via AXS online (see error message below). are u referring to other payment modes?

“Transaction Failed

Your payment card is not accepted. Please try again or use another card.”

Grabpay does not work with axs. I am referring to insurance providers who accept credit card payment e.g. Aia

oic! good thing i have not tried to load all the money into grabpay phew

I think it does I just did it last night!

this has been so, for very long already

Anyone has data points on paying non prudential insurance with Stanchart prudential card? Rewards points earned? Also, do you need to be a prudential policy holder?

Oh thanks Aaron. Wasn’t aware Amex card don’t earn points for all insurance payments anymore. Bummer

Hi Aaron,

Just sharing, for Singlife, first premium only is only for Grow policies, their other life policies allow use of all 3 credit cards for recurring payments. Have been using AMEX to pay for my CI policy 😀

thanks for the clarification!

Maybank Platinum VISA card has 3.33% cashback for Insurance premium payments.

Think UOB Absolute Cashback doesn’t exclude insurance payments in the T&C… but it’s AMEX

Can citi payall be used for AIG? The CSO themselves also dunno

It’s also important to note that the daily transaction limit for GrabPay card is $5000

Hi Aaron,

Will paying insurance premiums via mAXS earn miles?

Wanted to apply for the Maybank Infinite Visa to pay for my insurance premiums renewal. Insurer side only accepts MasterCard for renewal payment only and I thought I can use the AXN machine to pay using the Maybank Infinite Visa card. While browsing through the card’s T&C they also specifically exclude payment paid using AXN. So although this card technically award miles for payment of insurance premium but there isn’t a channel we can use to benefit from it. Are there other options to use a Visa card to pay for renewal insurance premium (other than AXN) and hope to be awarded miles/points?

UOB Krisflyer card’s T&C seems to indicate that it doesn’t exclude insurance payment

KrisFlyer UOB Account | UOB SingaporeTERMS AND CONDITIONS GOVERNING KRISFLYER UNITED OVERSEAS BANK LIMITED (“UOB”) DEBIT CARD AND KRISFLYER UOB ACCOUNTS AND SERVICES

Well… the T&C on this main page is updated Nov 2022 but probably missing the insurance exclusion

I found same Nov-2022 updated T&C on Moneysmart having insurance exclusion

Hi Aaron,

Clause 8f of the SCB Prudential card states

“The following transactions will not be considered as Qualifying Prudential Card Transactions. Qualifying Foreign Currency Transactions or Qualifying Dining Transactions:

f. recurring payments (being automatic payments where you, the principal or supplementary cardholder of a Prudential Card, have given a one-time authorisation or instruction for the merchant to charge the payment directly to your Prudential Platinum Cards or Prudential Signature Card (as the case may be) at a fixed interval, such as transactions made pursuant to Standard Chartered Bank (Singapore) Limited’s 0% Interest Instalment Plan) or payments made to all billing organisations using Standard Chartered Online Banking or mobile app;

Given most of our insurance payments are recurring, I suspect premiums won’t count as qualifying transactions…..

couldn’t you make ad hoc payments though? that’s what I do for my policies

Hi Aaron, able to advise if you have experience making 1 time annual payment via AXS, does the prudential platinum card recognize 1pt for every dollar paid on the insurance policies through AXS?

Are travel insurance typically under the same MCC? Or they still earn miles as online transaction (under other MCC?), thus, online card like WMMC will still earn points/miles.

travel insurance is insurance.

can i ask, how do your pay insurance premium for singlife? don’t seems to have a link to pay

Only an Ascend by Prudential customer is eligible for the Prudential Visa Signature Card.

@aaron, got to update this article to reflect that grabpay doesnt work with Amex cards any more.

Well, it does for another week or so

Well, now Grabpay just doesn’t work “any more” PERIOD

hihi, Im thinking OCBC N90 with cardup? isit a good choice?

Hi Aaron, to clarify SC Prudential non-VI for me to get a higher mpd I should apply for another SC X card?

The problem is some insurance companies like AIA only accepts Mastercard when making renewal premium payments and the only way a visa card can be use is through the AXS channel which the T&C of the visa card specifically exclude for awarding of miles

Getting miles or cashback from paying insurance is getting more difficult. Many do not accept AMEX cards and others like AIA only allow Master card. Either you use Prudential Visa signature card or Maybank. Otherwise for payment that requires Master card I am using Debit Card UOB Krisyfler.

I have given up trying to earn points on insurance. I charge it to any credit card if accepted, and then pay credit bills by GIRO through HSBC Everyday Global Account. At least I get back 1% rebate for that.

TIL on the Maybank card. As it happens I do have insurance premiums in a foreign currency. Thanks!

only reason i’m using the maybank VI card, combining with the airport transport service and it’s actually not bad.

Is the $600 annual fee waivable?

Hi, is the code MILELION for card up insurance payment still valid?