While it’s “free” to use your credit card in Singapore (unless the merchant imposes a surcharge, which they’re technically not supposed to), using it overseas incurs an explicit cost due to the foreign currency (FCY) transaction fees imposed by banks.

And yet, many credit cards offer an upsized earn rate on FCY transactions. For example:

- Citi PremierMiles Cardholders earn 1.2 mpd for all SGD spending, but 2.2 mpd for FCY spending

- DBS Altitude Cardholders earn 1.3 mpd for all SGD spending, but 2.2 mpd for FCY spending

So the question is whether it’s worth using your card overseas, and the answer depends on:

- How much you value a mile

- How much you’re paying for miles when you use your card overseas

(1) is a subjective measure, which I’ve addressed in this article. (2) is much more objective, and the focus of the discussion below.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 🛍️ Atome |

| 💰 CardUp | 🚗 Car Rental | 💗 Charity |

| 🍽️ Dining | 🏫 Education | ⚡ EV Charging |

| 🥡 Food Delivery | 🏨 Hotels | ☂️ Insurance |

| 📱 Kris+ | ⚕️ Medical | 🏖️ Overseas |

| 💊 Pharmacies | ⛽ Petrol | 🚍 Public Transport |

| 🛒 Supermarkets | 🚰 Utilities | 💒 Weddings |

How much do banks charge for FCY transactions?

When you make a credit card transaction in a currency other than Singapore Dollars, what typically happens is the amount is first converted to USD, and then into SGD, based on rates provided by American Express, Mastercard or Visa.

| 💳 Example: DBS Bank |

| “Visa/Mastercard transactions in US Dollar shall be converted to Singapore Dollar on the date of conversion. Transactions in other foreign currencies will be converted to US Dollar before being converted to Singapore Dollar.” |

There’s some spread involved here (usually <0.5%), but the biggest expense is the FCY transaction fee charged by the bank.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

You’d think that with competition from alternatives like YouTrip and Revolut, banks would be moderating their FCY transaction fees.

Fat chance— if anything, they’ve been edging upwards over the years. When I first started this blog in 2015, fees were in the range of 2.5-2.8%. Now, almost all the banks are at 3.25%, with Standard Chartered the “market leader” at 3.5%. Let’s not forget that Maribank initially proposed a 3.77% FCY fee, before cutting it down to 3%!

Summary of FCY Fee Changes, 2018 to Present

- On 1 Apr 18, Maybank increased its FCY charge on Visa Diamante, Visa Infinite and World Mastercard from 2.5% to 2.75%

- On 4 Oct 18, Citibank increased its FCY charge from 2.8% to 3%

- On 1 Nov 18, HSBC increased its FCY charge from 2.5% to 2.8%

- On 1 Jan 19, CIMB removed the admin fee waiver for FCY transactions on the Visa Signature and Platinum Mastercard, effectively increasing the fee from 1% to 3%

- On 2 Jan 19, DBS increased its FCY charge from 2.8% to 3%

- On 15 Jan 19, BOC increased its FCY charge on Mastercard transactions from 2.5% to 3% (Visa fees increased from 2.5% to 3% on 1 Dec 18)

- On 15 Mar 19, OCBC increased its FCY charge from 2.8% to 3%

- On 4 Sep 19, UOB increased its FCY charge from 2.8% to 3.1%

- On 1 Nov 19, DBS increased its FCY charge from 3% to 3.25%

- On 3 Dec 19, OCBC increased its FCY charge from 3% to 3.25%

- On 15 Dec 19, Citibank increased its FCY charge from 3% to 3.25%

- On 1 Mar 20, AMEX increased its FCY charge from 2.5% to 2.95%

- On 9 Mar 20, UOB increased its FCY charge from 3.1% to 3.25%

- On 1 Nov 21, Maybank increased its FCY charge from 2.75% to 3.25%

- On 4 Jan 23, HSBC increased its FCY charge from 2.8% to 3.25%

- On 1 Oct 2023, AMEX increased its FCY charge from 2.95% to 3.25%

Don’t forget that the FCY transaction fees are charged on top of the implicit spread in the Mastercard or Visa exchange rate. For example:

- A US$100 transaction charged to a Mastercard would cost S$134.81, assuming no FCY transaction fees (spot rate: S$134.12)

- Once a 3.25% FCY transaction fee is factored in, the amount becomes S$139.19

| ❓ How much will my overseas transaction cost? |

| If you want to know how much a given FCY transaction will cost, you can use the Mastercard or Visa currency converter calculators. All you need to enter is the bank’s FCY fee, which you can find in the table above. |

| Mastercard Calculator |

| Visa Calculator |

What’s the cost per mile?

No one likes to pay more than they have to, but do the miles earned for overseas transactions justify the costs?

Generally speaking: yes, although some cards represent better options than others.

General Overseas Spending

The following cards offer bonuses on all FCY transactions, regardless of MCC (except those on the general exclusions list, such as government services or insurance premiums).

| Card FCY Fee |

FCY Earn Rate | Cost Per Mile |

DCS Imperium Card DCS Imperium Card3.25% Apply |

4 mpd1 No cap |

0.81 |

Maybank XL Rewards Card Maybank XL Rewards Card3.25% Apply |

4 mpd2 | 0.81¢ |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa3.25% Apply |

4 mpd3 | 0.81¢ |

Citi Rewards Citi Rewards3.25% Apply |

4 mpd4 Online Spend |

0.81¢ |

DBS Woman’s World Card DBS Woman’s World Card3.25% Apply |

4 mpd5 Online Spend |

0.81¢ |

UOB Visa Signature UOB Visa Signature3.25% Apply |

4 mpd6 | 0.81¢ |

StanChart Beyond Card StanChart Beyond Card3.5% Apply |

PP: 4 mpd PB: 3.5 mpd Regular: 3 mpd No cap |

PP: 0.88¢ PB: 1¢ Regular: 1.17¢ |

Maybank World Mastercard Maybank World Mastercard3.25% Apply |

3.2 mpd7 No cap |

1.02¢ |

Maybank Visa Infinite Maybank Visa Infinite3.25% Apply |

3.2 mpd8 No cap |

1.02¢ |

BOC Elite Miles Card BOC Elite Miles Card3% Apply |

2.8 mpd No cap |

1.07¢ |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature3.25% Apply |

2.8 mpd9 No cap |

1.16¢ |

StanChart Visa Infinite StanChart Visa Infinite3.5% Apply |

3 mpd10 No cap |

1.17¢ |

HSBC Premier Mastercard HSBC Premier Mastercard3.25% Apply |

2.76 mpd No cap |

1.18¢ |

StanChart Rewards+ StanChart Rewards+3.5% Apply |

2.9 mpd11 |

1.21¢ |

DBS Treasures Black Elite DBS Treasures Black Elite3% |

2.4 mpd No cap |

1.25¢ |

HSBC TravelOne Card HSBC TravelOne Card3.25% Apply |

2.4 mpd No cap |

1.35¢ |

UOB PRVI Miles Card UOB PRVI Miles Card3.25% Apply |

3 mpd (IDR, MYR, THB, VND) 2.4 mpd No cap |

1.08¢ (IDR, MYR, THB, VND) 1.35¢ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card3.25% Apply |

2.4 mpd No cap |

1.35¢ |

DBS Altitude AMEX DBS Altitude AMEX3% Apply |

2.2 mpd No cap |

1.36¢ |

OCBC VOYAGE (Premier, PPC, BOS) OCBC VOYAGE (Premier, PPC, BOS)3.25% |

2.3 mpd No cap |

1.41¢ |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite3.25% |

2.24 mpd No cap |

1.45¢ |

DBS Vantage Card DBS Vantage Card3.25% Apply |

2.2 mpd No cap |

1.48¢ |

DBS Altitude Visa DBS Altitude Visa3.25% Apply |

2.2 mpd No cap |

1.48¢ |

OCBC VOYAGE OCBC VOYAGE3.25% Apply |

2.2 mpd No cap |

1.48¢ |

Citi PremierMiles Card Citi PremierMiles Card3.25% Apply |

2.2 mpd No cap |

1.48¢ |

OCBC 90°N Card OCBC 90°N Card3.25% Apply |

2.1 mpd No cap |

1.55¢ |

Citi Prestige Card Citi Prestige Card3.25% Apply |

2 mpd No cap |

1.63¢ |

HSBC Visa Infinite HSBC Visa Infinite3.25% Apply |

2 mpd No cap |

1.63¢ |

StanChart Journey StanChart Journey3.5% Apply |

2 mpd No cap |

1.75¢ |

| Not showing options earning <2 mpd |

||

| 1. Min. S$4K FCY spend per c. month, otherwise 2.4 mpd 2. Min. spend S$500 per c. month, capped at S$1,000 per c. month 3. Must use mobile contactless, capped at S$1,110 per c. month (S$600 from 1 Oct 2025) 4. For online spend, capped at S$1,000 per s. month 5. For online spend, capped at S$1,000 per c. month 6. Min. spend S$1,000 in FCY per statement month, capped at S$1,200 per s. month 7. Min. spend S$4,000 per c. month. 2.8 mpd with min. spend S$800 per c. month. 0.4 mpd otherwise 8. Min. spend S$4,000 per c. month. 2 mpd otherwise 9. Min. spend S$800 per c. month. 1.2 mpd otherwise 10. Min. spend S$2,000 per s. month. 1 mpd otherwise 11. Capped at S$2,222 per membership year |

||

| *Fee refers to the FCY transaction fee imposed by banks, and does not include the spread charged by Mastercard or Visa, which can add an additional 0.3-0.5% depending on currency |

||

I want to highlight the trio of Maybank cards (Visa Infinite, World Mastercard, Horizon) because of their relative lack of exclusion categories. If you were to charge education, utilities or insurance premiums (Horizon and Visa Infinite only) in FCY, you will earn 2.8-3.2 mpd, subject to meeting the monthly minimum spend. That could be very lucrative for anyone with overseas tuition bills to pay, for example.

Specific Overseas Spending

If you’re clocking FCY spend on particular categories, the cards below can also be options.

| Card FCY Fee |

FCY Earn Rate | Cost Per Mile |

UOB Lady’s Card UOB Lady’s Card3.25% Apply |

4 mpd1 | 0.81¢ |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card3.25% Apply |

4 mpd2 | 0.81¢ |

OCBC Rewards Card OCBC Rewards Card3.25% Apply |

4 mpd3 | 0.81¢ |

HSBC Revolution HSBC Revolution3.25% Apply |

4 mpd4 |

0.81¢ |

KrisFlyer UOB Card KrisFlyer UOB Card3.25% Apply |

2.4 mpd5 | 1.35¢ |

| 1. Pick 1: Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport, Travel. Capped at S$1,000 per c. month (T&Cs) 2. Pick 2: Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport, Travel. Capped at S$750 per category per c. month (T&Cs) 3. Capped at S$1,110 per c. month (T&Cs) 4. Capped at S$1,500 per c. month until 28 Feb 2026, then S$1,000 (T&Cs) 5. Min. S$1,000 spend on SIA Group in a membership year (T&Cs) |

||

| *Fee refers to the FCY transaction fee imposed by banks, and does not include the spread charged by Mastercard or Visa, which can add an additional 0.3-0.5% depending on currency |

||

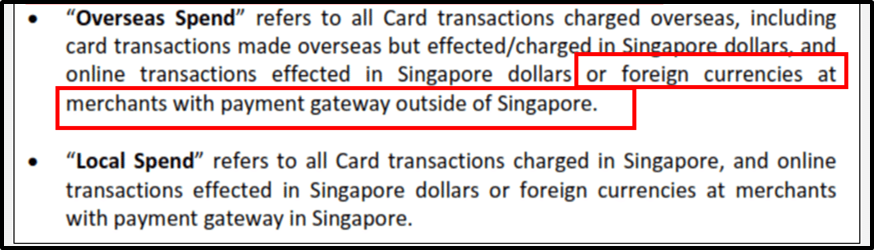

How do banks define overseas transactions?

For most banks, an “overseas transaction” is simply any transaction processed in a currency other than Singapore dollars.

But Bank of China and UOB add another condition: the payment gateway must be outside of Singapore. For example, if you were to book through the Hotels.com Singapore website and pay in Euros with your UOB PRVI Miles Card, you’d earn 1.4 mpd instead of 2.4 mpd because the payment is processed in Singapore.

How do you know where the payment gateway is located? You don’t. That’s the worst thing about such a rule: it puts the onus on the customer to find out information that’s not readily available.

If it’s any consolation, this is only an issue for online transactions. If you’re physically overseas when using your card, you don’t need to worry about where the payment gateway is located.

Moreover, there is a way of finding out where the payment gateway is located, if you’re willing to put in a little legwork.

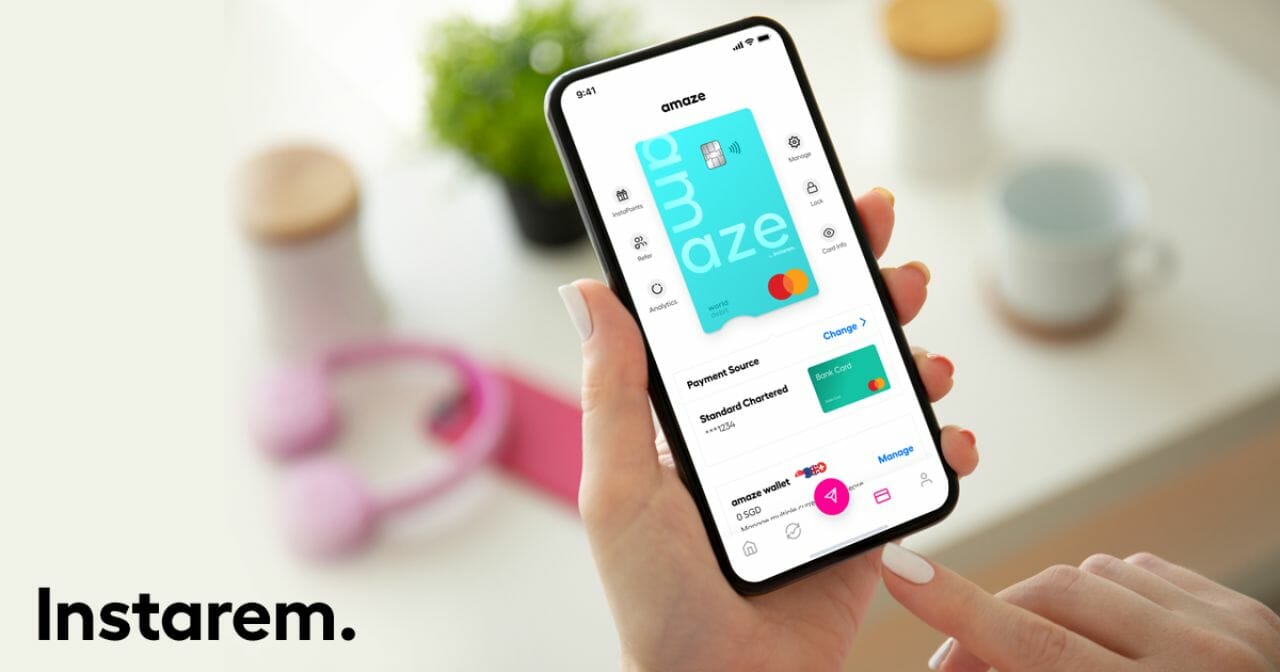

What about Amaze?

If you want to strike a balance between cost and rewards, Amaze would be the right option to use.

With Amaze, you’ll pay a ~2% markup over Mastercard rates, while continuing to earn regular credit card rewards of up to 4 mpd. This makes it a superior option to any traditional credit card, but only within the bonus caps.

|

| Apply here |

| Review |

| Use code MILELION for 3,000 bonus InstaPoints |

| 💳 tl;dr: Amaze Card |

|

The miles earned are limited only by the credit card linked to the Amaze, and the following pairings are recommended.

| 💳 Recommended Amaze Pairings |

||

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd1 | Max S$1K per s. month |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd2 | Min. S$500, max S$1K per c. month |

OCBC Rewards Card OCBC Rewards CardApply |

4 mpd3 | Max S$1.1K per c. month |

| 1. All online transactions except travel (airlines, hotels, rental cars, tour agency, cruises etc.) and in-app mobile wallet (T&Cs) 2. Dining, entertainment, shopping, travel (T&Cs) 3. Clothes, bags, shoes and shopping (T&Cs) |

||

A brief reminder of the ground rules for Amaze:

- Amaze transactions code as online

- Amaze transactions will be billed in SGD

- Amaze transactions retain the original MCC of the underlying merchant

- Amaze transaction descriptions are changed to AMAZE*merchant name

- Amaze can be paired with Mastercard cards only

- DBS, POSB and UOB cards no longer award points for Amaze transactions

- Citi excludes certain Amaze transactions related to AXS and transit (i.e. bus/MRT/EZ-Link), but otherwise awards points

It generally doesn’t make sense to pair Amaze with general spending cards, because you could derive a lower cost per mile by using non-Amaze options like the Maybank World Mastercard or DBS Woman’s World Card.

Refer to this article for more details.

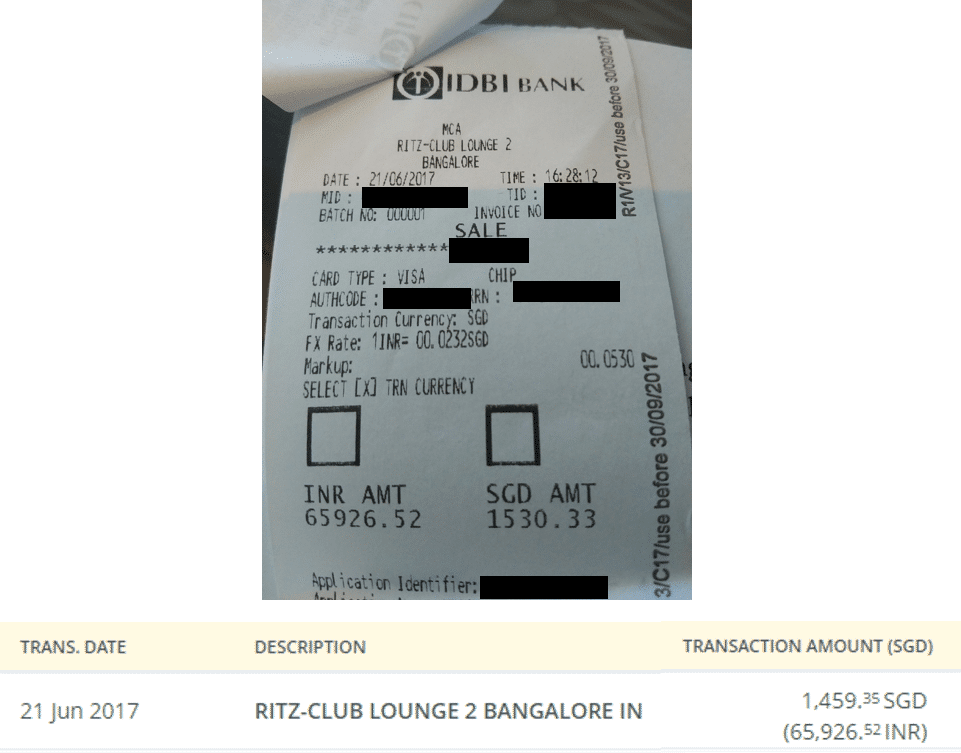

Beware of DCC!

Here’s my customary warning about the scam known as Dynamic Currency Conversion (DCC).

For the uninitiated, DCC is a “service” provided by merchants which converts the transaction into your card’s local currency, at a fee that’s much more than what your bank would charge. The merchant pockets part of the profit, so some unscrupulous places will instruct staff to select it by default, without the consent of the customer.

Be alert, and always, always emphasise that you want to be billed in the local currency. If you want to avoid the scourge of DCC altogether, use an American Express card, since AMEX does not support DCC.

What about zero FCY fee cards?

If you don’t care about credit card rewards and just want to minimise the cost of your transaction, then you can consider “zero FCY fee” cards such as:

- Chocolate Visa Card

- Trust Cashback Card

- Trust Link Card

- Revolut

- YouTrip

These cards offer better rates compared to bank credit cards, but the catch is that you either earn no rewards (Revolut/YouTrip), or minimal rewards (Trust Link/Trust Cashback).

Chocolate Visa Card Chocolate Visa Card |

|||

| Apply |

A noticeable exception is the Chocolate Visa Card, which earns:

- 1 Max Mile per S$1 on the first S$1,000 of spend per calendar month

- 0.4 Max Miles per S$1 on all spend above S$1,000 per calendar month

There is a cap of 100 miles per month on so-called bill payments, which include insurance, government services, healthcare, insurance, business services and utilities.

Of course, if you’re dealing with a scenario where rewards can’t be earned even with bank credit cards, such as education or charitable donations, then it’s simply a question of “damage minimisation”. In that case, the zero FCY fee cards would be the smart option, since there’s no reason to pay an FCY transaction fee when there’s no rewards in the picture.

| ❓ Is it really a no-rewards situation! |

|

Don’t be so quick to conclude that a given category is “unrewardable”! For example:

|

Credit card or multi-currency debit card?

|

|

|

| Trust Link / Cashback Card | Multi-Currency Debit Cards | |

| Pros |

|

|

| Cons |

|

|

If you’ve decided to go with a zero FCY fee card, the next question is whether you should choose the Trust credit cards, or a multi-currency debit card like Revolut or YouTrip.

Historically speaking, multi-currency debit cards were at a disadvantage because the MAS-imposed transaction limits restricted customers to keeping S$5,000 in a wallet at any time, and spending S$30,000 per year. These restrictions meant that customers wanting to make big ticket purchases would have to use a credit card instead.

But at the start of 2024, YouTrip became the first e-wallet to increase its stock limit (the amount that can be kept in the wallet) to S$20,000, and the flow limit (the amount that can be spent per 12-month period) to S$100,000. Revolut followed suit in the middle of 2024.

Therefore, multi-currency cards are at less of a disadvantage now, though if you were making a truly massive transaction then a credit card would obviously be the better choice.

The key advantage of multi-currency debit cards is that you’ll enjoy better rates than Visa, assuming it’s not the weekend (where rates can be worse).

| Amount | YouTrip | Visa | Spread |

| US$100 | S$135.24 | S$135.26 | ~0% |

| A$100 | S$89.21 | S$89.77 | 0.6% |

| ¥10,000 | S$86.13 | S$86.42 | 0.3% |

| €100 | S$146.20 | S$146.95 | 0.5% |

| £100 | S$171.67 | S$172.46 | 0.5% |

Moreover, a multi-currency debit card allows you to lock in today’s rates for future spend. For example, if you feel the JPY/SGD rate today is good, you can go ahead and buy JPY for your trip six months down the road (keep in mind there’s still the opportunity cost of funds to consider, since your YouTrip balance earns no interest).

In contrast, Trust credit cardholders can only take advantage of the prevailing rate at the time the transaction is processed.

So why consider Trust? Well, if you’re making a very big transaction that would bust even the increased YouTrip limits, then you might not have a choice. As a credit card, Trust is capped only by the assigned credit limit, and in my experience they’re very generous with this.

Then there’s fraud considerations. As a debit card, any transactions charged to your Revolut or YouTrip, whether fraudulent or legitimate, are immediately deducted from your account. There was a recent feature in CNA about the pitfalls of multi-currency card fraud prevention, including the horror story of a customer who found her YouTrip wallet drained by 31 unauthorised transactions in quick succession and had to wait months to recover her funds.

There are ways of protecting yourself, however, such as locking your multi-currency card whenever it’s not in use. If you’re only taking that trip a few months down the line, there’s no reason to leave your card unlocked in the interim.

In contrast, if your credit card gets hit by a fraudulent transaction, there is no immediate deduction of funds. You can spot the fraudulent transaction on your statement and open a dispute with the bank, and in the majority of cases you should receive a temporary credit to offset the disputed amount while investigations are carried out.

| 🏧 ATM withdrawals |

|

While cash-based transactions aren’t really the focus of this article, I should highlight that Trust has the upper hand when it comes to this. Trust allows you to make unlimited fee-free withdrawals from overseas ATMs, while YouTrip only offers S$400 of free withdrawals per month, after which a 2% fee applies. Revolut allows up to S$350 or five withdrawals per month on the Standard plan, after which a 2% fee applies. Do note that the overseas bank operating the ATM may impose a fee of its own, but that’d be the same whether you used Trust or Revolut/YouTrip. Also, when using Trust for ATM withdrawals, be sure to toggle it to debit card mode (on the app, switch the source to “pair with savings account”). You want to make a withdrawal from your Trust savings account (free), not a cash advance from Visa ($$$). |

On a similar note, debit cards do not support so called “authorisation holds”, the type required when you rent a car or check in to a hotel. This means that the hold amount is automatically deducted from your available funds, leaving you with less money on hand. For instance, if you have a YouTrip balance of US$1,000 and use the card to rent a car, and the rental car company puts a US$400 hold, you only have US$600 left to spend. If you used the Trust Card, there’d be no deduction of funds because it’s a credit card.

Finally, as a credit card, Trust allows you to stretch your cashflow. While multi-currency debit cards involve an immediate deduction from your account, transactions on the Trust Card are only due later when the statement amount becomes payable.

Between the Trust Link and Trust Cashback Card, the latter would be the better pick because it offers 1% cashback on overseas spend (though I feel dirty recommending it because its claims of 15% cashback border on fraudulent…).

Conclusion

While using your credit card overseas incurs extra costs because of foreign currency transaction fees, it can still be worthwhile, especially if you prioritise cards that earn 3-4 mpd, or if you can reduce those fees through Amaze.

I personally would be OK with options that keep the cost per mile below 1.5 cents, though the threshold will vary from person to person.

Of course, if your priority is minimising the total cost of the transaction, then a zero FCY card like Trust or Revolut would be the better option, since these offer superior exchange rates at the expense of earning rewards.

Does DBS WMC still give 4mpd when paired with Amaze? Some of the comments seem to suggest otherwise.

As of last month’s points crediting (transactions from Sep’21), I got my 4 mpd with DBS WWMC on 15th Oct for all my Amaze transactions, except the ones made on CardUp using my Amaze card.

Should HSBC revo be added to the list given it offers 4mpd albeit not on all categories and only 2.8% FCY fee? But most of what a general person would spend overseas would be on the categories that HSBC whitelists anyway e.g. airline, hotel, car rental, dining, travel agencies, supermarket, department stores, even uber (transport)?

revo is there, under specialised spending cards.

Thanks! Must have missed it. Think it’s the most attractive one for me given the low cpm

Thanks to your kind introduction of the Amaze card. It is now my default card for overseas expenditures.

How about pairing OCBC Titanium Rewards with Amaze? It does earn 4 mpd for shopping?

following. but my understanding from the other article seems to suggest so.

I’d also like to know if i charge foreign currency through amaze to ocbc 90n mc, is it considered foreign currency or sgd? because 90n gives 1.2mpd for local spend but 2.1mpd for forex, so it might actually be worth it to charge as forex despite the 3.25% fcy.

Does Amex Krisflyer card only earn 2MPD during the months of Jun and Dec?

correct

Hi Aaron, is the CPM for the American Express Platinum Charge Card also 0.98 cpm? Thanks!

What if a merchant charges DCC without giving me a choice (aka press yes and print for me to sign). what can I do?

Check before signing and ask them to reverse then charge in local currency.

What if they “refuse”?

Don’t sign. OR write DCC refused.

Dispute. No DCC gives only the SGD value for you to sign. It’s either FCY (in which case you can dispute) or FCY and SGD with boxes (in which case you tick the FCY box). Without a signature indicating your agreement, your bank will not honour thew charge. Had this several times with an StR…

https://milelion.com/2018/11/19/how-i-fought-and-won-a-dcc-dispute/

Hi Aaron, should Amaze cashback be reflected as 0.5% in the conclusion?

It’s 1% for overseas spend

I just came back from a 10-day trip and had been using Visa paywave (Apple Pay or the credit card directly). I was quite surprised that I wasn’t hit by DCC at all. All transactions were processed in the local currency without me even asking. Not sure if it was because DCC was not supported by contactless payments, or DCC was banned in that country?

Thanks for the review! I used the Amaze card with DBS WWMC for my entire UK trip! I won’t be applying for the CitiRewards card though, as I have too many cards. Pity that from 1 June, DBS WWMC will no longer be useful when tagged to the Amaze card for miles. I would be using ICBC Global travel mastercard instead (though this one no miles but has 3% cashback on overseas spend).

May I know why the Amex CPM is 0.98 for the krisflyer cards? it looks like it should be 2.95/2 = 1.475?

thanks for spotting that. have fixed it.

Sorry new to all this. For hsbc revolution, if I were to use pay wave overseas at a restaurant, will it be counted as 4mpd? Does this work by categories regardless if local or overseas? Sorry for the many questions. Thanks

Yes, overseas is fine

Hi Aaron, it’s probably time for an Amaze update. I find I’m getting charged ~2% spread for FCY transactions. Tested in TH, TW, MY in the last 2 months

Writing something on this, thanks!

its more than 2% – used Amaze in Japan this month and its 2.2% on FCY transactions. Saw the same for Euro transactions,

my transactions in USD and IDR have been at 1.8%. are you comparing to MC rates?

Which card should I use for big ticket (5-figure) overseas spending? I noticed that all the cards mentioned above have a 1-2k monthly limit, except maybe for OCBC Titanium Rewards with a S$13,335 limit for the first year.

good point. Im asking the same too especially 1 branded bag already cost 30K

Just calculate the theoretical average mpd on your big ticket purchase and measure it against using a general spending card with no cap?

I would use the UOB Krisflyer since they have no cap and use Amaze to qualify as an online transaction.

Hey guys, anyone has any tips to spend $800 on reasonable items on KrisShop to hit the SIA Group Spend? Thank you!

Having just made a big fuss with Amazon JP on the constant auto-DCC, I was surprised that my side by side purchases ended up cheaper on the Amazon DCC, though when taking the Amaze cashback into account, Amaze still beat out Amazon by a whisker. So so will continue to manually switch to local currency, but at least Amazon seems to offer a much more reasonable conversion now.

Amex converts to USD before converting to SGD. So on paper it is 2.95%, but you get hit with their FX spread twice, which usually leads to a worse outcome than any card with a 3.25-3.5% headline charge

Don’t all cards convert to USD before sgd?

UOB converts non-USD, non-AUD and non-SGD to USD before converting to SGD. So AUD and USD are the exception that gets converted to SGD directly. See https://www.uob.com.sg/personal/cards/credit-cards/terms-and-conditions.page

maybe I should rephrase, with other cards you pay the masterard/visa spread which is typically around 0.5% above mid-market. with amex you just get a really poor fx outcome, which is sad, since they control the entire chain. so lowest fee, but also poorest (typically) fx rate.

most of the times i have tracked, i have always received poorest SGD outcome with amex. so based on personal datapoints, i only use my amex when the final SGD figure is not my main concern

Thanks for this. I’ve been wondering what may be the reason why my PrviMiles amex have been returning such bad fx rates when I was expecting it to be similar to my Mastercards/Visa.

Does HSBC Evo give 4mpd for contactless overseas dining?

Citi Premiermiles is also running a 4mpd for till end June!

Hi Aaron, if I link the Lady Solitaire card to Amaze, which Solitaire bonus category should I pick for overseas spending using Amaze? Thank you for all the great tips so far!

Hi, May I check does HSBC TravelOne earn 1.2mpd for stacking with amaze too? Thank you

Stumbled here for the first time. Never really thought that one can benefit from credit card spending but learnt quite a bit here.

However, for a noob, I thought o just ask one question. I am going to make an overseas payment to Thailand which is equivalent of around $24k sgd and these visa fees payment

Which miles card would be best?

Any suggestions welcome.

Thanks in advance

For now it seems like it would be UOB’s PriviMiles with the uncapped 3mpd for THB. Just wondering which card you ended up using, and if you’re still having such expenses which card are you using today?

Hard to monitor and I think I just stick to cards that charge the minimum forex fees. Almost everyone I met on private trips have switched to Youtrip, Revolut etc instead of paying the 3.25 per cent forex trip. The banks are not doing anything about it so I guessed they do not value the individual’s business.

for HSBC revolution, overseas dining is also 4mpd right?

Hi hi, does Amaze x Krisflyer UOB card earn miles if I were to use it for Uber or Lyft overseas? Is it considered a “Transit” transaction?

And I assume using it to tap on metro/subway would register as a “Transit” transaction..?

Aaron, think you should revise the cpm tables to assume there is at least a 0.5% spread on Visa/Mastercard rate, and even better if you assume two different spreads because Mastercard is known to have a lower spread. I was confused the first few times I read this article because you discuss the Visa/Mastercard spread but your examples do not include this spread. It’s very important because if you assume a 0.5% spread, then anything lower than 2.4 mpd (UOB PRVI Miles) is higher than 1.50 mpd or your personal miles valuation. In reality, using a Visa like Visa Signature… Read more »

Hi Aaron, does Amaze pairing to pay something in foreign currency (in my case, recurring monthly bills in USD) work for online FCY transaction too? By “work” I mean, I can still earn the miles from my CC as well as save on FCY fees. Or does it strictly work for in-person oversea transaction? Thanks

Hi did you figure out if amaze citi rewards of online FCY transactions still earn 4 miles per dollars?

Beware of the recent MCC 8999 exclusion by UOB. I spent $$$ in FCY at overseas locations which in no way should be classified as 8999. I’m guessing they slipped under my radar before as I never had these transactions excluded in the past. With more and more MCCs excluded any MCC misclassification will be more likely to have an impact.

By the way Revolut does offer rewards now (RevPoints) which can be converted to avios and others.

Do note I think it’s not available in Singapore yet but is available in select EU countries

will keep an eye on this!

Be very careful with the UOB Lady Card – especially overseas. I had the dining and travel categories selected. However around 50% of the time, the dining category does not work. So you end up really with more like 2mpd (if you are lucky). Using an MCC doesn’t work far too often. I have stopped using this card and told UOB it is not fit for purpose.

were you in japan? japan is known for so called “monkey mcc”, where restaurants and dining places can code as really unexpected things.

but that’s not UOB’s fault, really. they don’t control how MCCs are assigned, and their dining MCC coverage is pretty standard.

Yes, Japan was one country. But also similar issues with other countries. As you point out, UOB say, correctly, the MCC assignment is out of their control and therefore it is just unfortunate. My point is that it out of the customers control too, and UOB is relying on a method that simply fails too often – they need to come up with a better way, and until they do, in my opinion, the card is not fit for purpose.

I notice that Visa chargeback code 12.2 includes “Incorrect merchant category code”. If the MCC error is egregiously wrong I wonder if you can try to do a charge back otherwise the consumer seems to be SOL. (BTW UOB doesn’t care as it helps their bottom line until they lose business by annoying too many customers).

Yes as said above UOB does not assign the MCC. But UOB does use the MCC to deny rewards. UOB is obviously aware that MCCs can be incorrect and knowing this UOB is complicit in using them and giving their customers no avenue for appeal.

I just stick to Trust Cashback card with its 1 percent cashback so 4.25% difference with other Singapore bank issued cards. Hard to monitor the various MCC. Trust Cashback, I found is less sticky with MCC. I think better to have lower cost than miles especially regular downgrading of what each mile can get you. Keep the money and you still get interest. However, I noted that for example Malaysian banks seems to charge a lower FCY fee. Perhaps Singapore banks charge one of the highest in the world averaging 3.25 percent.

Wondering what’s your thought now that Chocolate Finance Visa card with 0% fees as you’ve mentioned in Chocolate Visa Card: Earn 2 Max Miles per S$1 on virtually everything. It can be consider a slower earn rate at zero cost, while have the benefits of HeyMax partners, where would you rank it amongst the other cards? (though it’s debit v.s. credit; not sure if that or other factors matter)

Doesn’t UOB PPV gives 4mpd on mobile transactions? Or it excludes foreign transactions

it does- see second table.

Some bank cards have a high mpd earn rate but their points are awarded for every S$5 spend which means there’s slippage and there’s a short expiry (e.g. 2-3 years) compared to a lower earn rate card like Citi but can earn for every S$1 spend and has no miles expiry. Would this be critical to which card to use, especially for a fuss-free user who just wants to earn miles for all their spend without worrying about categories and minimum spend? I’m torn between UOB VI and Citi Prestige/Premier miles. Or what is the best recommendation for such a… Read more »

The only card with no annual fee, no DCC possibility, no spending minimum/cap, no spend categories, no wireless / contact less / online requirement, 2.4 mpd, 3% charge, no points expiry is the Treasures Black Elite? I used it everywhere in Seoul and Tokyo and New York. No problems. No thinking required. Credit card protections when traveling, at the lowest 3% fee for SG issued credit card and got reasonable 2.4mpd. No need to beg for fee waiver. No DCC shenanigans. No debit card issues especially on car rentals. No need to cash out points every year on time. No-brainer.

How does DCS compare in the list? Seems like for uncapped foreign spending Maybank is top on the list.

Has anyone tried to switch currency from SGD to a FCY when paying on a e-commerce site, eg Emirates.com, in order to get higer mile per dollar? Any tips and is it worth?

Readers might also be unaware that in Australia and New Zealand, there is an almost universal credit card surcharge of anything between 1 and 3%. There are moves afoot to change this but as of mid-2025, its the norm.

Thank you for updating this article. Wanted your thoughts on whether you’d pair Amaze with a general spending card (say UOB prvi) or use youtrip/revolut after you’d maxed out all the 4mpd cards?

KF Debit earns .4 miles per $ equiv when spending fx balances.

Could you add UOB FX+ card to your review?

Stanchart Visa Infinite should be 3.5% FCY fee

thank you! have corrected that.

how about pairing amaze with Maybank world Mastercard? Would it still be considered as foreign currency?

Your cost per mile should take into account not just the FCY Fee but also the potential cashback forgone if one were to use a cashback zero FX card like Trust.

Hi Aaron, I would like to share my personal experience on fraudulent transactions involving my Amaze card in September this year. In September 2025, I topped up my Amaze card with USD8000 in view of an upcoming family trip to USA. The only transaction that I had was to apply for ESTA for my family and this was paid using the Amaze card online. The ESTA website was legit and I did not click on any other links. On the same day, I went to JB for dinner and used the Amaze card via Apple wallet. Shortly after, I found… Read more »

Topping up 8K like a debit card? I thought Amaze was to pair with MC credit cards? Sorry I don’t know because I don’t use Amaze. How did the top up work, was it like a stored value debit card like Revolut or YouTrip?

I also don’t use debit cards whatever the savings might supposedly be. Only simple ATM cards and credit cards. Spending time trying to get the money back is like getting robbed again.

Just an update. I got my money in back in SGD after 2 months.

It was not a good experience.

Will definitely be locking my debit cards whenever not in use.

How about AMEX Singapore Airlines Solitaire PPS CC?