Each year, I create a wishlist of things I’d love to see happen in the miles and points world. While some wishes might be a little optimistic, others have actually come true!

So in keeping with that tradition, here’s The MileLion’s Christmas Wishlist for 2024 — presented in no particular order of preference (or realism, for that matter).

But first…

How did 2023’s wishlist go?

Pretty good, actually! From my 2023 Christmas wishlist:

- Scoot began flying to Koh Samui in May 2024, providing Bangkok Airways with some much-needed competition

- American Express eased the restrictions on HighFlyer points transfers in July 2024, removing the nominee limit and increasing the cap per nominee to 100,000 miles (up from a mere 30,000 miles)

- Singapore Airlines didn’t quite unveil its B777X cabin products, but has pledged to have them flying by Q2 2026 on the A350-900LH, and Q1 2027 on the A350-900ULR (with a First Class cabin, to boot!)

- HSBC added points pooling across all its cards in May 2024, giving all cardholders access to its 20 transfer partners

Not everything’s hunky dory though. My wish that banks would sensibly implement anti-malware measures has rather backfired; if anything, they’re getting increasingly paranoid and disruptive. I had another nightmare experience with OCBC in October 2024, when a bad update incorrectly flagged TikTok, Fake GPS and other innocuous apps as remote administration tools and locked me (and many other users) out. Keep in mind: OCBC didn’t actually say which app was the problem, this was only discovered through guess and check!

Here’s a rundown of previous years’ wishlists and how successful they’ve been.

2015 Christmas Wishlist

| 🎄 2015 Christmas Wishlist |

|

2016 Christmas Wishlist

| 🎄 2016 Christmas Wishlist |

|

2018 Christmas Wishlist

| 🎄 2018 Christmas Wishlist |

|

2019 Christmas Wishlist

| 🎄 2019 Christmas Wishlist |

|

2020 Christmas Wishlist

| 🎄 2020 Christmas Wishlist |

|

2021 Christmas Wishlist

| 🎄 2021 Christmas Wishlist |

|

2022 Christmas Wishlist

| 🎄 2022 Christmas Wishlist |

|

2023 Christmas Wishlist

| 🎄 2023 Christmas Wishlist |

|

(1) Extending the UOB Lady’s Savings Account promotion

The UOB Lady’s Cards ended their 6 mpd promotion in April 2024, but immediately followed it up with a new offer called “The Unstoppable Pairing”, designed to reward UOB Lady’s Cardholders who also hold a UOB Lady’s Savings Account.

The interest on this account is a miserly 0.05% p.a., but the interest isn’t the point. Instead, accountholders can earn an extra 2-6 mpd on their UOB Lady’s Card spending, depending on their Monthly Average Balance (MAB).

| Monthly Average Balance | UNI$ from Lady’s Savings Account | UNI$ from Lady’s or Lady’s Solitaire Card | Total |

| <S$10K | N/A | 10X UNI$ (4 mpd) |

10X UNI$ (4 mpd) |

| S$10,000 to S$49,999 | 5X UNI$ (2 mpd) |

15X UNI$ (6 mpd) |

|

| S$50,000 to S$99,999 | 10X UNI$ (4 mpd) |

20X UNI$ (8 mpd) |

|

| S$100K and more | 15X UNI$ (6 mpd) |

25X UNI$ (10 mpd) |

I’ve made the argument why S$10,000 is the sweet spot, because the incremental 2 mpd should more than offset the foregone interest (the opportunity cost for S$50,000 and S$100,000 would be simply too high). And I’ve put my money where my mouth is, diligently maxing out the cap on the UOB Lady’s Solitaire Card each month for 12,000 miles per month (just a shame the bonus cap was cut from S$3,000 to S$2,000!).

But The Unstoppable Pairing is positioned as a limited-time promotion, and it’s currently set to end on 31 March 2025. I don’t know about you, but I wouldn’t mind too much if they extended it (who needs the KrisFlyer UOB account?).

(2) Make it easier to add infants to Singapore Airlines award bookings

While there have been incremental improvements to the Singapore Airlines website over the years, it still lacks a lot of functionality when it comes to award bookings: no open jaw awards and no mixed cabin bookings, for example.

One big pain point for parents is adding infant tickets to award bookings. Unlike commercial bookings, this cannot be done online. Instead, you’ll have to book your award first, then call up KrisFlyer membership services to add the infant.

This process takes at best 10 minutes or so. You’ll need to verbally communicate your infant’s name and birthday, and the CSO has to manually calculate the fare- both of which are prone to human error. I’ve had to correct CSOs on more than one occasion, as the adult fares they were basing the infant ticket on were higher than the ones I could find on the website.

But it doesn’t have to be this way. With other programmes, like Air Canada Aeroplan or British Airways Executive Club, adding an infant is as easy as booking an adult’s ticket. I’m not even asking KrisFlyer to adopt their much-superior pricing (with Aeroplan you pay a flat CAD25 or 2,500 points per infant, with BAEC you pay 10% of the adult mileage requirement), but please, could you make the website better?

(3) Starlink internet for the Singapore Airlines fleet

While Singapore Airlines became the first Asian carrier to offer free inflight Wi-Fi to all passengers in July 2023, it’s lagging behind when it comes to speeds.

On all the flights that I’ve tested, whether using the Panasonic Avionics or SITAOnAir systems, I’ve never had anything faster than an 8 Mbps download speed. Most of the time, speeds hover in the 2-3 Mbps range- usable, but barely. Forget about Netflix and chill, you’d be lucky to send a naughty emoji at that speed.

But faster inflight speeds are possible; just ask Qatar Airways. Qatar Airways has partnered with Starlink to bring satellite internet to its fleet, boasting real-world speeds of about 150 Mbps. That’s fast enough for 4K video streaming, or even playing online games.

Starlink has already signed up Air France, Air New Zealand, Hawaiian Airlines, and ZIPAIR, to name a few, and I’m certainly hoping that Singapore Airlines is taking a serious look at the technology.

(4) More $200K credit cards

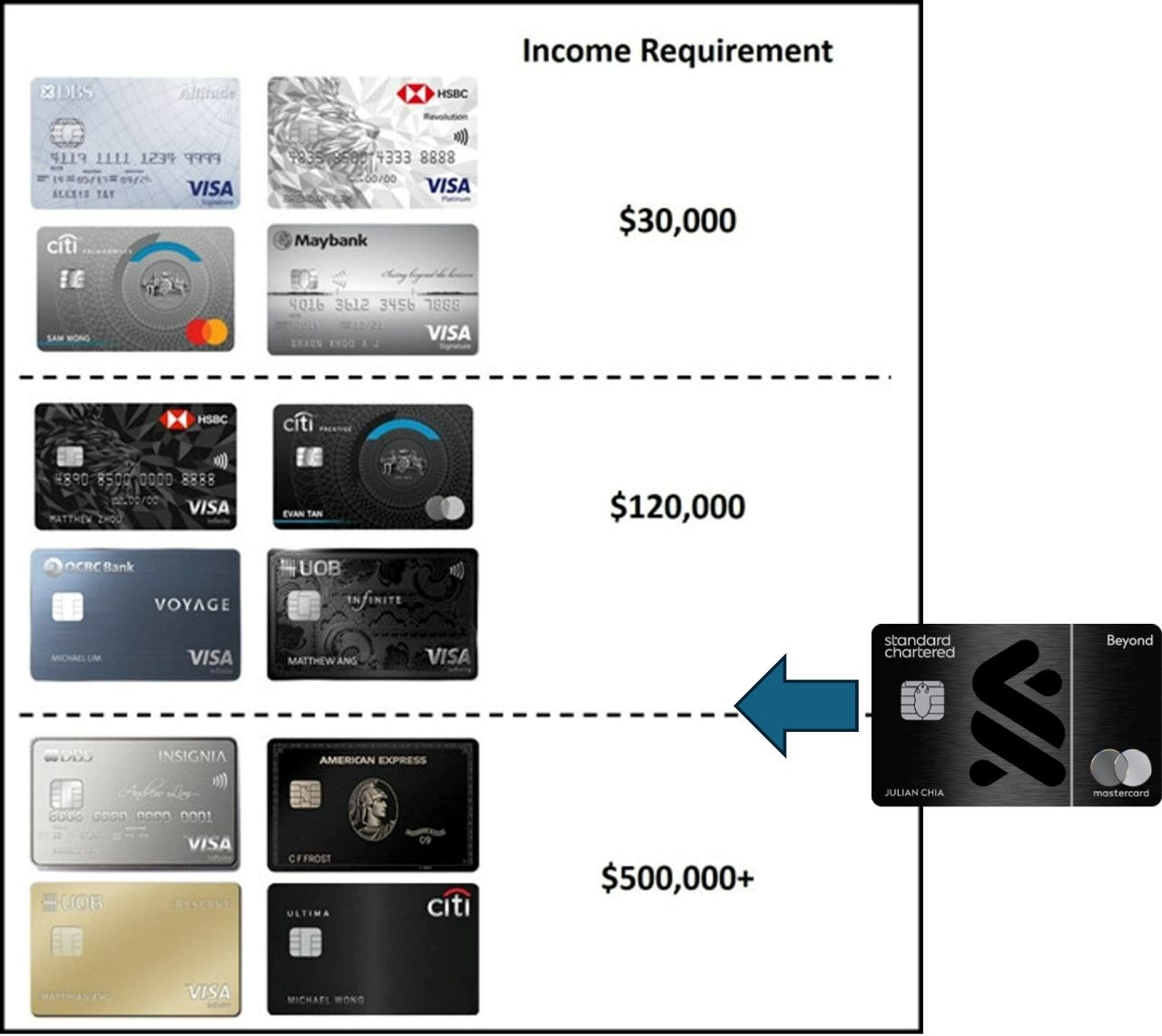

Towards the end of 2024, we saw the debut of the StanChart Beyond Card, Standard Chartered’s follow up to the ill-fated X Card.

This is quite clearly intended to be a flagship product, but unlike other flagships such as the Citi ULTIMA or DBS Insignia, which have minimum income requirements of S$500,000 and annual fees in the S$3,000 to S$4,000 range, the Beyond has a minimum income of S$200,000 and a S$1,635 annual fee.

This suggests that Standard Chartered is trying to carve out a new niche: a product with significantly better benefits than the $120K pack, yet stops short of the annual fees of the $500K segment. I call this, somewhat unimaginatively, the “$200K segment”.

While I’m not completely sold on the StanChart Beyond Card, I do like the idea of an in-between product, and in 2025 I’d like to see more banks dipping their toes into the water. Can I get something that’s superior to a Citi Prestige, without the white glove service of the Citi ULTIMA?

The only other card I can think of that’s currently in this segment is the AMEX Platinum Charge, which has a similar annual fee to Beyond. Yes, I’m aware it doesn’t have an official income requirement anymore, and AMEX pretty much accepts anyone who doesn’t flinch at the S$1,744 entry fee. But it did start life with a S$200,000 income requirement, and if you’re the type who can afford a Platinum Charge, a Beyond wouldn’t be beyond you.

I do know what some banks are seriously looking at this segment, and if the Beyond does well, who knows?

(5) Singapore Airlines making no-fly status credits a permanent feature

During the pandemic, Singapore Airlines allowed KrisFlyer and PPS Club members to earn Elite miles and PPS Value on the ground through KrisShop purchases, Kris+ payments, cobrand card spending and conversion of credit card points.

Thanks to that campaign, I earned enough Elite miles to qualify for KrisFlyer Elite Gold till October 2024, and those who timed their transfers just right will have status all the way till February 2025.

This was only a limited-time concession, however, and ended once things returned to normal. But we did see a brief revival of this mechanic from March to June 2024, with PPS Club and KrisFlyer members able to earn 2,500 PPS Value or 5,000 Elite miles without having to fly.

My wish is that Singapore Airlines makes no-fly status credits a permanent feature of the programme. I’m not saying that everyone should be able to earn PPS Club status just by transferring credit card points. What I am saying is that a certain amount of Elite miles or PPS Value — maybe 10-20% of the requirement for KrisFlyer Elite Gold or PPS Club — could be earned through on-ground activity.

The general idea is that the on-ground component should be small enough that the elite ranks don’t get clogged with members who hardly do any flying, but large enough that it incentivises members at the margins to make that incremental effort.

Some suggestions of what this might look like can be found in the article below.

Should Singapore Airlines make no-fly status credits a permanent feature?

(6) A XNAP replacement

For those looking to earn credit card rewards at QR-code only merchants, XNAP was an absolute godsend.

All transactions made through XNAP coded as MCC 5814 Fast Food Restaurants, which meant you could earn 4 mpd on vegetables at the wet market or hawker centre, at mom-and-pop merchants and otherwise cash-only establishments.

But then in April this year, XNAP just stopped working. A notification about “maintenance” was posted to the website, attempts to reach customer service were unsuccessful, and the XNAP Facebook page taken down. After publishing about the outage, I received an email from the Head of Marketing and Communications at Liquid Group, inviting me to reach out with questions. I did — twice — and never heard back from her.

With XNAP gone, the main options for earning miles at QR-code only merchants are AMEX Pay and Shopback Pay, but neither has anywhere close to the adoption that XNAP did. Besides, the earn rate for AMEX Pay is limited by the AMEX cards themselves. If you’re lucky and have an AMEX HighFlyer Card, you’ll earn 1.8 mpd. Otherwise, 1.2 mpd with the AMEX KrisFlyer Ascend is as good as it gets for most people.

(7) A Centurion Lounge at Changi Airport

An AMEX Centurion Lounge at Changi Airport is a wish I know won’t be fulfilled for a very long time— if ever. Finding a space for a Centurion Lounge in the existing three terminals (because I just can’t see it being at T4) will be a tall order, so if we ever do see one, it probably won’t happen till Terminal 5 in the mid-2030s.

While the AMEX Centurion Lounges in the US are notorious for overcrowding issues, I do find the quality of F&B to be a big step up from your average credit card lounge. I know it reads like a punchline, but one of the best lounge meals I’ve had this year came at the Centurion Lounge at Los Angeles, where I demolished maybe half a tureen of Brussel sprouts and pasta— it was that good!

Centurion Lounges do have an international footprint, but the only “true” lounges are in London Heathrow, Hong Kong and Tokyo Haneda (opening 2025). All the rest are reflagged legacy American Express lounges, which might not be to the same standard.

Singapore would be a nice addition to that list. Just saying.

Conclusion

So that’s my hopes and dreams for the miles and points game in 2024! I’d love to hear what’s on your wishlist, and what you think the odds are of any of mine happening.

Here’s to a 2025 with no devaluations, great sweet spots, and plenty of award space for everyone!

What’s on your miles and points wishlist this year?

thank you for your list Aaron and your blog again this year. My wish would be for a higher tier than TPPS/Solitaire as I find 50’000 SGD/year at tad light if compared to the equivalents of other programs, for example HON Circle over at M&M. The only issue I have is that apart from granting Private Room access for flights in Business/First (no Economy), I don’t see any advantage that can be given. I dismiss the amount of Upgrade Vouchers or other non-physically experienceable perks. What do you think?

i think it’s quite likely there’s already an unofficial tier beyond solitaire. SQ obviously tracks its whale customers, and even though they’re solitaire on paper they’ll get the kind of special treatment that regular solitaires can only dream of (like pick up the phone and saver award space magically appears).

thank you for your comment Aaron. What kind of revenue are you thinking of?

Honestly, anything I tell you would be a wild guess on my part. But I’m quite certain it exists, because SQ has a way of inviting its “more valuable” Solitaire PPS members for certain events, so it must be keeping tabs.

Many airlines have a dedicated relationship team with their largest commercial clients.

Not individuals rated on a “top tier” on the consumer grade scale – it’s generally corporate or governmental clients, with negotiated rates & terms. Priority/guaranteed bookings are often a key part, VVIP services etc.

#8: DBS and UOB re-instate miles for transactions using the Amaze Card.

next week: CITI TO NERF AMAZE TRANSACTIONS

R U F R ???

Another wish list would be for more co brand cards in Singapore. We are stuck with a paltry amount that partners only SQ and pathetic co brand benefits.

Or even better hotel co brand cards with hotel elite benefits. The credit card scene is so bad. Everything in SG is simply cookie cutter template.

More co branded cards won’t be of any use if their benefits are mediocre. You know which card I’m talking about …

Hi Aaron, I’ve got a taste of your review on a cashback card this year with the DCS Flex card. I know that you say that cashback cards are not your lane, but I really appreciate your thoughts on cards outside the usual miles card, such as the Citi SMRT Card and some less-known cards like the BOC Family Card (3% Cashback for Hospital). In fact, I would really like to see a revival of the The Milelion Credit Card Omnibus series. Having a short analysis with a Yay or Nay is nice, but I am looking forward to your… Read more »

Seconded!

i take it you’ve seen this already?

https://milelion.com/2024/12/10/should-you-earn-miles-with-a-cashback-card-instead/

and there have been a few cashback posts in 2024 actually!

https://milelion.com/2024/06/21/new-hsbc-live-card-8-cashback-on-dining-entertainment-and-shopping/

https://milelion.com/2024/08/28/distrust-trust-banks-misleading-new-cashback-card/

more pls

-insatiable gen z

I am a simple person with no big wishlist

Just no more nerfs and I would be happy

No devaluations from SQ!