It’s not hard to find a card that offers bonus miles for shopping. After all, buying clothes, bags, shoes, jewellery and electronics is exactly the kind of discretionary spend that banks want to incentivise.

What is hard is deciding which card to use, because each bank defines shopping differently. Some limit it to traditional categories like department stores and fashion boutiques, while others include pharmacies, music stores, book stores, florists, and even computer software!

So the way I see it, there are two questions to answer:

- Which cards offer the most miles for shopping (quantity)

- Which cards have the widest MCC coverage for shopping (quality)

Which cards offer the most miles for shopping?

| 💳 Best Cards for Shopping |

||

| Card | Earn Rate No. of MCCs |

Remarks |

HSBC Revolution HSBC RevolutionApply |

4 mpd 38 MCCs |

Max S$1.5K per c. month* Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd (Online) 36 MCCs |

Max S$600 per c. month Review |

Maybank XL Rewards Card Maybank XL Rewards CardApply |

4 mpd 13 MCCs |

Min. S$500, max S$1K per c. month Review |

OCBC Rewards OCBC RewardsApply |

4 mpd^ 13 MCCs |

Max S$1.1K per c. month Review |

Citi Rewards Citi RewardsApply |

4 mpd (Offline) 11 MCCs |

Max S$1K per s. month Review |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd 10 MCCs |

Max S$1K per c. month, with Fashion as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd 10 MCCs |

Max S$750 per c. with Fashion as bonus category Review |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

2.4 mpd (Online) 29 MCCs |

No cap. Min. S$1K spend on SIA Group in a m. year Review |

| C. month= Calendar month | S. month= Statement month | M. year= Membership year | ||

| *Cap reverts to S$1K per c. month from 1 March 2026 ^6 mpd for Watsons, Shopee, Lazada, TikTok Shop and Taobao till 31 December 2025 |

||

Let’s start with the easy part: which cards offer the most miles for shopping?

There’s no shortage of options here, with a total of eight cards claiming shopping as a bonus category. Seven of them offer up to 4 mpd, but the HSBC Revolution stands out for covering the most MCCs and offering the highest bonus cap of S$1,500 per calendar month (until 28 February 2026, after which it reverts to S$1,000).

Otherwise, the Maybank XL Rewards Card is a good choice, though I’d personally rather conserve its 4 mpd cap for foreign currency and travel-related spend.

If you’re shopping at Watsons, Shopee, Lazada, TikTok Shop and Taobao specifically, then the OCBC Rewards Card is offering an excellent 6 mpd earn rate for the rest of 2025, capped at S$1,000 per calendar month.

Big spenders might want to consider the KrisFlyer UOB Credit Card instead, which offers an uncapped 2.4 mpd on online shopping, provided the cardholder spends at least S$1,000 on SIA Group transactions (Singapore Airlines, Scoot & KrisShop) in a membership year. Mind you, this was even more generous prior to June 2025, when cardholders earned an uncapped 3 mpd.

You might be confused to see the UOB Preferred Platinum Visa, because we often think of it as a blacklist card that earns 4 mpd everywhere mobile payments are accepted. That’s correct– if you’re paying in-store. If you’re paying online, then bonuses are awarded according to a specific MCC whitelist. Remember, from October 2025, you must spend across both online and offline categories to fully utilise its S$1,200 monthly bonus cap.

Likewise, the Citi Rewards Card is often thought of as a blacklist card that earns 4 mpd for all online payments. But if you’re paying in-store, then bonuses are awarded according to a specific MCC whitelist.

Which cards cover the most MCCs?

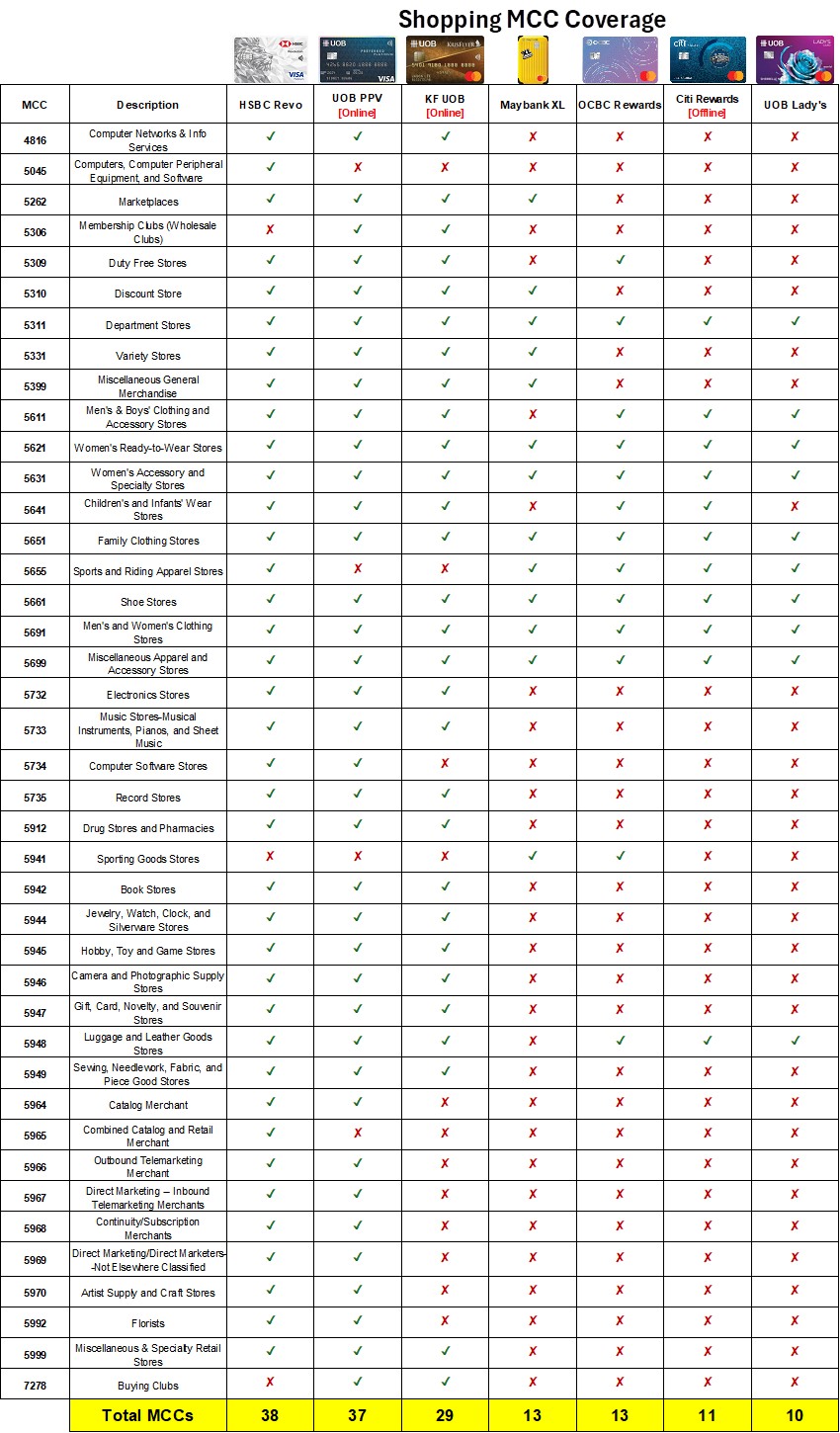

Like I said, “shopping” is a very nebulously-defined term. Each bank defines it differently, so to aid comparisons, I compiled the full list of shopping MCCs from the eight cards.

As it turns out, a total of 41 MCCs can come under the umbrella of shopping. I’ve summarised the results in the table below (for brevity’s sake, I’ve collapsed the UOB Lady’s Card and UOB Lady’s Solitaire into a single column).

If you’re ever uncertain about the MCC, there are three ways of looking it up before making a purchase:

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem App | ●● | ●● |

| 🤖 DBS Digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

The core MCCs

What’s interesting is that there are seven “core” MCCs which will trigger the shopping bonuses across all cards.

- MCC 5311 Department Stores

- MCC 5621 Women’s Ready to Wear Stores

- MCC 5631 Women’s Accessory and Specialty Stores

- MCC 5651 Family Clothing Stores

- MCC 5661 Shoe Stores

- MCC 5691 Men’s and Women’s Clothing Stores

- MCC 5699 Misc. Apparel and Accessory Shops

This would include all major departmental stores like BHG, Isetan, Marks & Spencer, Takashimaya and TANGS, as well as most fashion boutiques.

More crucially, MCC 5311 is also used for HeyMax gift card purchases, which means you can use it as an “MCC switcher”. For example, Deliveroo would normally code as MCC 5814 for transactions made directly, but buying a gift card via HeyMax switches it to 5311, effectively letting you use a shopping card for dining.

|

|

| Sign up here | |

|

|

Therefore, MCC 5311 is arguably the most important shopping MCC to include, because it opens up many other possibilities!

OCBC Rewards Card: Not just MCCs!

The table above tends to understate the coverage of the OCBC Rewards Card, because it also explicitly whitelists the following merchants.

| 💳 OCBC Rewards Bonus Whitelist (Based on Merchant Name) |

|

|

|

| ^Amazon and Mustafa Centre transactions under MCC 5411 are not eligible to earn any OCBC$ *Shopee Pay transactions under MCC 5262 are not eligible to earn any OCBC$ |

|

Since all three major pharmacy chains in Singapore are included, you could argue that MCC 5912 (Pharmacies) is as good as a bonus category.

UOB Lady’s Card/Lady’s Solitaire: Category matters!

The UOB Lady’s Card and Lady’s Solitaire require cardholders to select one or two bonus categories respectively, which can be rotated each quarter.

For the purposes of the table, I’ve listed the MCCs under the ‘Fashion’ category. But it’s worth noting that you can also earn 4 mpd on MCC 5309 Duty Free Stores, provided you select the ‘Travel’ category.

Conclusion

Plenty of credit cards offer bonuses for shopping, and while it’s natural to focus on the earn rates, the devil is in the details. Some cards restrict their definition of shopping to as little as 10 MCCs, while others cover nearly 40.

Of course, you can also use generic blacklist cards for this category (e.g. DBS Woman’s World Card for online shopping, or the UOB Visa Signature for offline shopping), but it makes more sense to conserve their bonus caps for other types of spending.

Nice write-up! I was wondering, how come UOB VS isn’t part of the comparison?

see last paragraph.