2025 certainly wasn’t short on drama, with nerfs to lounge benefits, UOB’s newfound love for sub-caps, the AMEX Platinum Charge’s existential crisis, Maybank’s creeping rewards exclusions, hellos to new cards, goodbyes to others, and of course, the small matter of the KrisFlyer devaluation.

But there were some things which really got people talking, and it’s time to take a look back at the biggest stories on The MileLion, defined as the ones which got the most reads.

| ⚠️ Note: Most read stories, not articles |

| This top 10 list features the most read stories, not articles per se. If we did a recap of the top 10 articles strictly based on readership, they’d all be credit card reviews or guides (the most read post for 2025 was the review of the UOB Preferred Platinum Visa, at 330K). I’m delighted you find these so helpful, and will keep them regularly updated for 2026. But for now, let’s just talk news stories! |

| Rank | Article | Reads |

| 1 | Review: UOB Preferred Platinum Visa | 330K |

| 2 | Review: UOB Visa Signature | 254K |

| 3 | Review: Citi Rewards Card | 230K |

| 4 | Review: UOB Lady’s Card | 229K |

| 5 | Review: KrisFlyer UOB Credit Card | 208K |

| 6 | Review: DBS Woman’s World Card | 196K |

| 7 | Review: HSBC Revolution Card | 132K |

| 8 | Review: UOB PRVI Miles Card | 117K |

| 9 | HSBC Revolution restores travel and contactless bonuses, raises monthly bonus cap by 50% | 116K |

| 10 | Best Cards for Overseas Spending | 113K |

(1) HSBC Revolution restores travel and contactless bonuses, raises monthly bonus cap by 50%

HSBC Revolution restores travel and contactless bonuses, raises monthly bonus cap by 50%

The big turnaround story this year was the HSBC Revolution, which started 2025 as a niche card, and ended it as a wallet essential.

Who could have seen this coming? At the start of the year, the HSBC Revolution cut its bonuses for airlines, car rental, cruises and lodging, adding on to 2024’s removal of bonuses for contactless spending, groceries, fast food, and travel agencies. As if that wasn’t bad enough, HSBC also devalued points conversions to KrisFlyer, becoming the first bank in Singapore to offer an inferior ratio for KrisFlyer compared to other frequent flyer programmes.

But then in July 2025, HSBC not only restored bonuses for travel and contactless payments; it also boosted the monthly bonus cap by 50% to S$1,500. This promotion, originally scheduled to run until the end of October, was later extended to 28 February 2026.

It’s not all sunshine and unicorns, since the continued exclusion of MCC 4722 (Travel Agencies) and MCC 5814 (Fast Food) creates the potential for gotchas, when you find out a merchant doesn’t code exactly the way you thought it would.

Still, I would never have imagined such a dramatic reversal of fortunes for the Revolution this time last year, so credit where it’s due- this is quite the Lazarus story.

(2) Nerfed: UOB Preferred Platinum Visa splits bonus cap into two sub-caps

Nerfed: UOB Preferred Platinum Visa splits bonus cap into two sub-caps

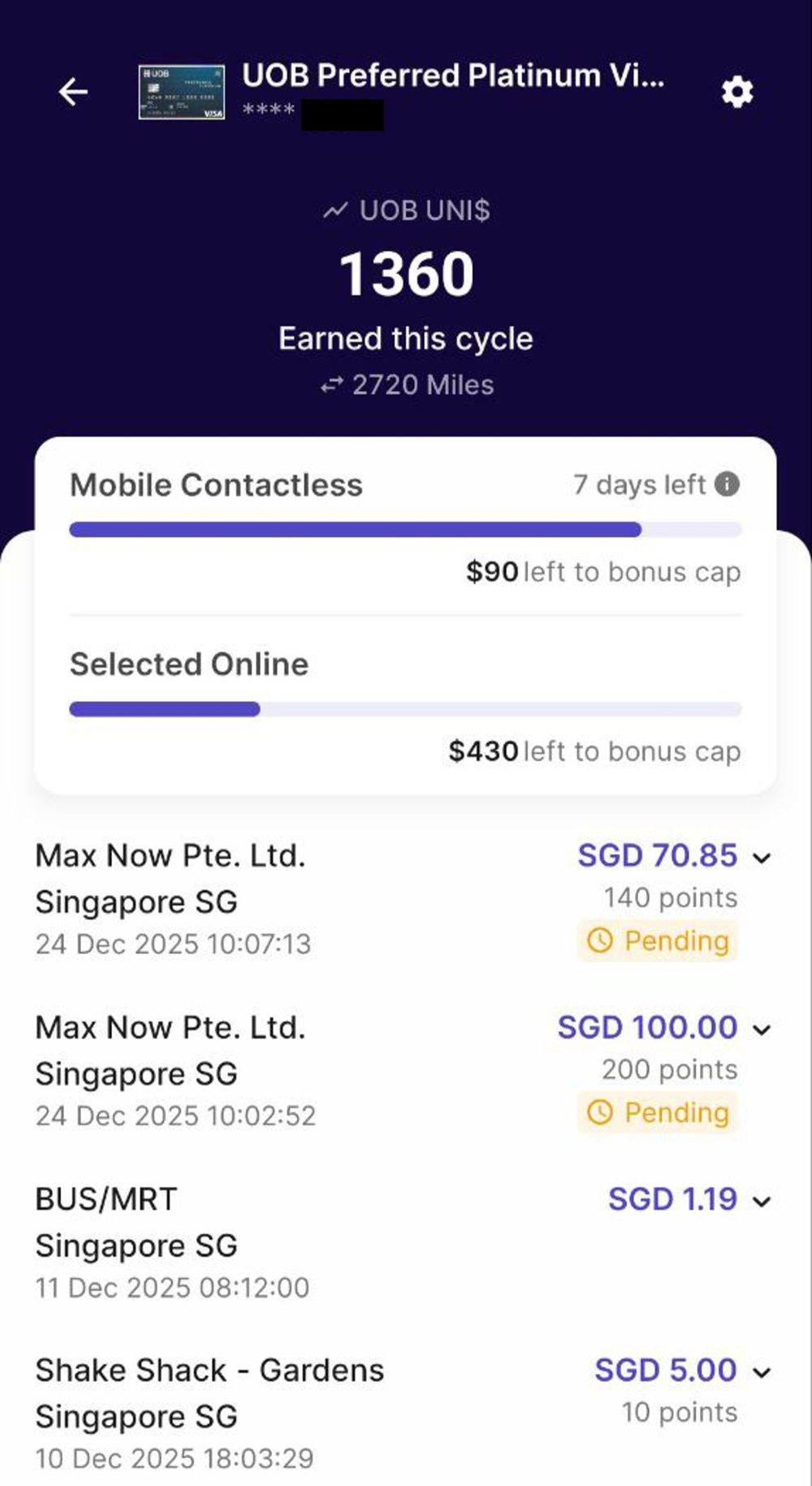

After the UOB Lady’s Solitaire and UOB Visa Signature introduced bonus sub-caps, it was only a matter of time before the UOB Preferred Platinum Visa followed likewise.

This happened on 1 October 2025, and spelled the end of using the UOB Preferred Platinum Visa as a “one and done” solution for 4 mpd on S$1,110 of contactless payments each month.

Instead, cardholders now earn 4 mpd on S$600 of contactless payments per month, with a separate S$600 bonus cap allocated to selected online transactions like shopping, entertainment and dining.

| Category | Min. Spend | Bonus Cap |

| Mobile Contactless | N/A | S$600 per c. month |

| Selected Online Transactions (e.g. dining, entertainment, shopping, supermarkets) |

N/A | S$600 per c. month |

This makes it much harder to fully max out the card’s bonus cap, and the only silver lining here is that HeyMax recently added the ability to track bonus caps on its app, helping to reduce much of the cognitive load.

(3) Mandai Rainforest Resort by Banyan Tree Review: Critically endangered

Mandai Rainforest Resort by Banyan Tree Review: Critically endangered

Of all the hotel openings in Singapore this year, there was perhaps none more anticipated than the Banyan Tree Mandai, a 4.6-hectare eco-resort built in the heart of the five surrounding wildlife parks.

On paper, this should be a winner: give me a serene retreat nestled within Singapore’s premier wildlife precinct over cosplaying a tourist in Orchard Road or Marina Bay any day. But my visit left a lot to be desired. Leaving aside the ever-present mosquitos (which I wouldn’t hold against them, since that’s just part and parcel of being in Mandai), there were so many service own goals unbefitting a brand like Banyan Tree.

Welcome emails sent at 10.30 p.m the night before arrival (and responses ignored in any case), there was no water at the gym or pool, the entertainment systems in the gym didn’t work, discarded towels and trash were left at the pool for long periods of time, and staff members came off as inexperienced (a few were unable to speak any English).

The rooms were pleasant enough, though the water pressure wasn’t great and the air conditioning couldn’t be adjusted below 24°C to save on electricity bills the earth, a decidedly punitive measure in a hot and humid environment like Singapore.

Recent reviews appear to be better, so perhaps those were just teething issues. Either way, I wouldn’t mind returning for the signature cocaine rice…

(4) Which credit cards allow you to access Priority Pass lounges directly?

Which credit cards allow you to access Priority Pass lounges directly?

It’s a headache to manage multiple Priority Pass memberships, and since visits outside of your entitlement cost US$35 a pop, mixing them up can be a costly mistake.

However, Priority Pass has a feature known as Access on Payment Card, or AoPC, which allows cardholders to access lounges simply by presenting their credit card. This removes all ambiguity as to which membership is attached to what card. It also takes care of issues with expired or missing physical cards.

Unfortunately, AoPC has not been widely adopted in Singapore. At the time of writing, it’s only offered on the following cards:

- HSBC Premier Mastercard

- HSBC Prive Card

- StanChart Beyond Card

- UOB PRVI Miles Mastercard

- UOB PRVI Miles Visa

Hopefully, more cards will adopt this going forward, as that’d be a huge quality-of-life improvement.

(5) AMEX Platinum Charge nerfs Priority Pass visits for supplementary cards

AMEX Platinum Charge nerfs Priority Pass visits for supplementary cards

2025 got off to a bad start for AMEX Platinum Charge cardholders, with nerfs to the Platinum Statement Credits and Comoclub birthday perks.

But worse was to come in February, when supplementary cardholders learned that their Priority Pass membership would be cut from unlimited visits — with one guest each time — to just eight visits for the entire year (remember, Priority Pass memberships from American Express already don’t cover non-lounge airport experiences such as restaurants or spa treatments). As a consolation, they still retained unlimited access to the Centurion and Plaza Premium Lounges, but neither has the scale of Priority Pass.

Of course, this wasn’t the only card to nerf lounge access in 2025. In April 2025, the UOB Visa Infinite Metal Card quietly added a cooldown period of at least four hours between DragonPass utilisations, and will cap DragonPass visits at 12 per year from June 2026. In July 2025, the Citi Prestige Card capped Priority Pass visits at 12 per year.

At the rate things are going, I wouldn’t be surprised if we see similar reductions from other $120K cards like the OCBC VOYAGE, and unlimited lounge access ceases to be a benefit of this segment.

(6) UOB Visa Signature adds 4 mpd for SimplyGo and increases bonus caps (but it’s not all good)

UOB Visa Signature adds 4 mpd for SimplyGo and increases bonus cap (but it’s not all good)

In August 2025, there was good news and bad news for UOB Visa Signature Cardholders.

The good news was that SimplyGo transactions, long excluded from the card’s definition of contactless spend, would now be eligible to earn 4 mpd. Moreover, the monthly bonus cap of S$2,000 would be boosted to S$2,400.

The bad news? That bonus cap would now be divided into two strict sub-caps of S$1,200 each.

| Category | Min. Spend | Bonus Cap |

| Contactless & Petrol | S$1K per s. month | S$1.2K per s. month |

| Foreign Currency | S$1K per s. month | S$1.2K per s. month |

This effectively killed the strategy of using the UOB Visa Signature for S$2,000 of local contactless spending each month. And if you weren’t travelling overseas that month, you could pretty much forget about 50% of the card’s bonus capacity (online spending was an option, but rare is the person who can reliably clock S$1,200 of online FCY spend each month).

So even though on paper this was a buff to the bonus cap, in practice most people will be earning far fewer miles.

It’s almost as if that was the plan all along!

(7) Chocolate Visa Card: Earn 2 Max Miles per S$1 on virtually everything

Chocolate Visa Card: Earn 2 Max Miles per S$1 on virtually everything

Chocolate Finance was looking to make a big splash with its Chocolate Visa Platinum Debit Card, so in February 2025, it launched an unbelievable offer: 2 Max Miles per S$1, on up to S$1,000 each month.

Wait, just 2 mpd? Why would you take that instead of the 4-6 mpd that other cards had to offer?

Well, I haven’t got to the best part yet. There were virtually no exclusions. Not for charitable donations, education, hospitals, insurance premiums, utilities, or even AXS transactions.

I’m sure you know how this story ends. Barely one month later, AXS removed support for the Chocolate Visa Card. Or at least, that’s what Chocolate Finance claimed. AXS quickly set the record straight and said that it was Chocolate who requested the removal.

People weren’t happy, there was a run on the not-a-bank, and Chocolate eventually nerfed the earn rate by half while adding a cap of 100 Max Miles per month on “bill payments”, effectively excluding them from rewards.

These days I hardly touch my Chocolate card except in very limited circumstances.

(8) Amaze adds 1% fee for all SGD spend, nerfs InstaPoints even further

Amaze adds 1% fee for all SGD spend, nerfs InstaPoints even further

Amaze has been dying the death of a thousand nerfs, so perhaps it shouldn’t have been all that surprising that in March 2025, it expanded the 1% fee on SGD-denominated transactions to cover all SGD spending, instead of just amounts beyond S$1,000.

This greatly diminished the use case for pairing it with the Citi Rewards for local spending, especially for smaller transactions (since the fee has a minimum of S$0.50).

Not just that, but Amaze also removed InstaPoints for card-linked spend entirely. InstaPoints would only be awarded for spending funded by the Amaze wallet, which basically forced you to choose between earning credit card rewards or InstaPoints.

Since this happened, I’ve mostly been confining my Amaze card usage to my overseas trips (which I believe was the point), pairing it with the Citi Rewards or Maybank XL Rewards Card. And aside from one solid promotion which upsized the InstaPoints earn rate for wallet-linked spend, InstaPoints have become all but irrelevant to me.

(9) SIA x SG60 celebrations: Promo fares, upsized Spontaneous Escapes, special meals and more

SIA x SG60 celebrations: Promo fares, upsized Spontaneous Escapes, special meals and more

Singapore celebrated its 60th birthday this year, and Singapore Airlines marked the occasion with a series of special fares for SIA and Scoot, SG60 vouchers for Pelago and Kris+, and special lounge and inflight meals.

But perhaps the bigger news was the teasing of a special edition of Spontaneous Escapes…to take place four months later. That turned out to be 40% off (because 100% – SG60= 40%, see?), upsized indeed but not exactly the biggest discount we’ve ever seen.

(10) UOB One Account nerfing interest rates to 3.3% p.a. from May 2025

UOB One Account nerfing interest rates to 3.3% p.a. from May 2025

Here’s a sobering thought. This year saw not one, not two, but three separate nerfs to the UOB One Account’s interest rates.

At the start of the year, cardholders could still earn a very respectable 4% p.a. on up to S$150,000 by simply crediting a monthly salary of at least S$1,600, and spending at least S$500 a month on the UOB Lady’s Card or other selected cards.

But then came the cuts: first in May 2025 to 3.3% p.a., then in September 2025 to 2.5% p.a., and then in December 2025 to 1.9% p.a. Given all that’s happening right now, I wouldn’t even rule out further cuts in 2026!

It’s a shame, because the UOB One Account is often considered the best bank account for miles chasers- unlike other “hurdle accounts” which require customers to spend on cashback cards, purchase overpriced investment or insurance products, or take out a mortgage.

Looks like I’ll have to put everything back into crypto then…

Conclusion

With all the nerfs and buffs that happened in 2025, there was no shortage of things to write about. If anything, the year should have reinforced a few familiar lessons: no card is ever safe from a devaluation, “enhancements” often aren’t, and always make hay while the sun shines, because today’s wallet essential can become tomorrow’s sock drawer resident.

But 2025 wasn’t all bad. If nothing else, the HSBC Revolution’s redemption arc showed that banks can walk back bad decisions, and Chocolate Visa promotion injected some thrill back into the game— however short-lived.

So that’s a wrap on 2025. Here’s to an equally eventful 2026 (in a good way, one hopes)!