Kris+ has launched a new edition of Miles Rush, which offers a flat 6 mpd at 26 dining and retail partners across Singapore including Bengawan Solo, Krispy Kreme, Bacha Coffee, and llaollao.

On top of this, you can stack a further 4 mpd by paying with the right credit card, earning 10 mpd in total.

|

|||

| S$5 for new Kris+ Users | |||

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

Details: Kris+ Miles Rush

From 1-31 August 2025, Kris+ will boost the earn rates at the following 26 merchants to a flat 6 mpd.

| Merchant | Regular rate | Promo rate (1-31 Aug 2025) |

| Bacha Coffee | 3 mpd | 6 mpd |

| Bengawan Solo | 2 mpd | 6 mpd |

| Benjamin Barker | 2 mpd | 6 mpd |

| Cherry & Oak | 2 mpd | 6 mpd |

| Chingu Dining | 4 mpd | 6 mpd |

| Chokmah | 5 mpd | 6 mpd |

| Crafune | 3 mpd | 6 mpd |

| Dancing Crab | 5 mpd | 6 mpd |

| Eater’s Market | 4 mpd | 6 mpd |

| For the Love of Laundry | 2 mpd | 6 mpd |

| Heveya | 5 mpd | 6 mpd |

| House of Traditional Javanese Massage | 3 mpd | 6 mpd |

| Joy Luck Teahouse | 3 mpd | 6 mpd |

| Kind Kones | 4 mpd | 6 mpd |

| Krispy Kreme | 3 mpd | 6 mpd |

| llaollao | 3 mpd | 6 mpd |

| Lynk Fragrances | 4 mpd | 6 mpd |

| Menya Kokoro | 3 mpd | 6 mpd |

| Perk by Kate | 5 mpd | 6 mpd |

| Rappu | 4 mpd | 6 mpd |

| Rave Karaoke | 3 mpd | 6 mpd |

| Sospiri | 5 mpd | 6 mpd |

| The Feather Blade | 4 mpd | 6 mpd |

| Toss & Turn | 5 mpd | 6 mpd |

| Workspace Grains and Cafe | 5 mpd | 6 mpd |

| Yue Hwa Chinese Products | 3 mpd | 6 mpd |

No registration is required, and the upsized earn rates will already be reflected on the Kris+ app by default.

Even if you have no plans to spend at these merchants in August, you can “lock in” the bonus by purchasing vouchers during the promotional period, which can then be used any time before expiry.

Expiry dates will vary by merchant, so always check the fine print before pulling the trigger.

Earning miles via Kris+

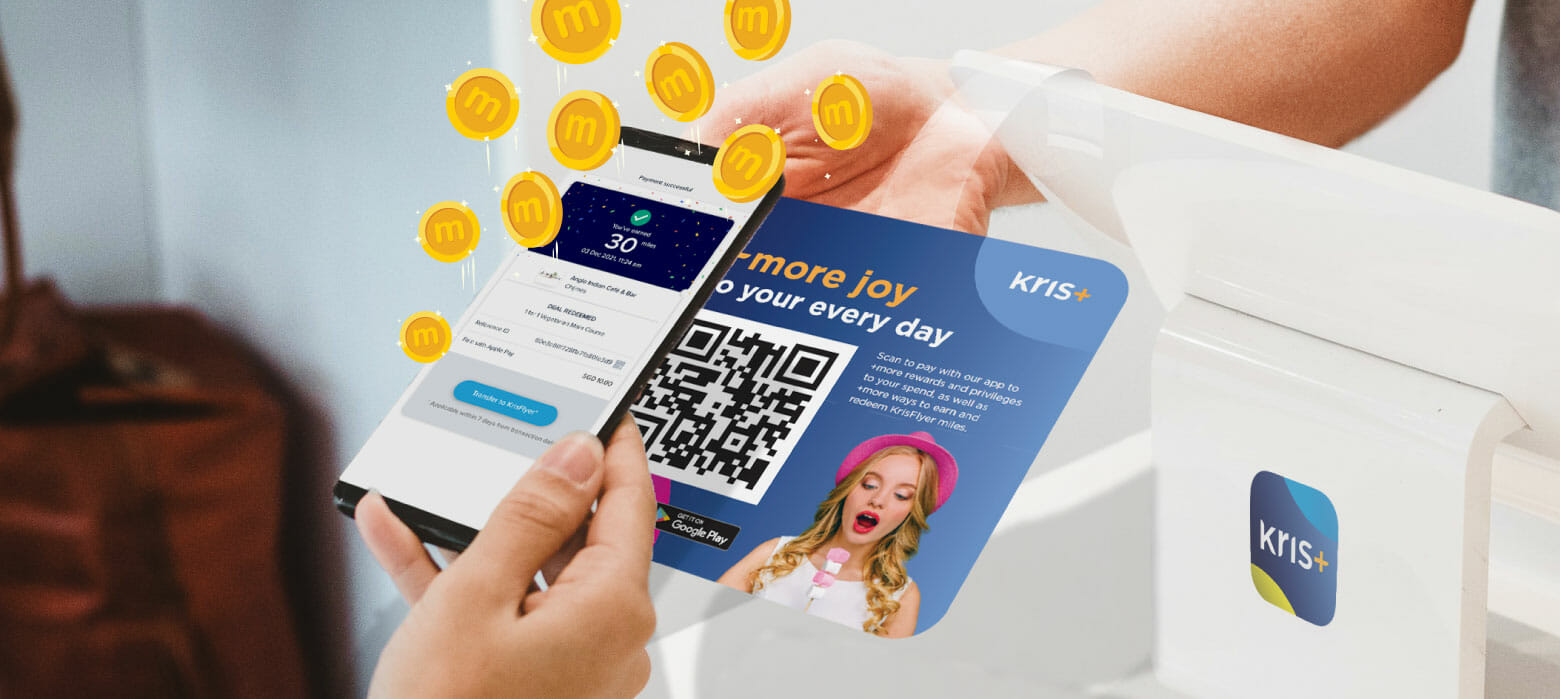

Earning miles at Kris+ merchants is simple. All you need to do is:

- Scan the merchant’s Kris+ QR code (which is now part of SGQR)

- Enter the amount to be paid, and press “Pay” to pay via Apple/Google Pay

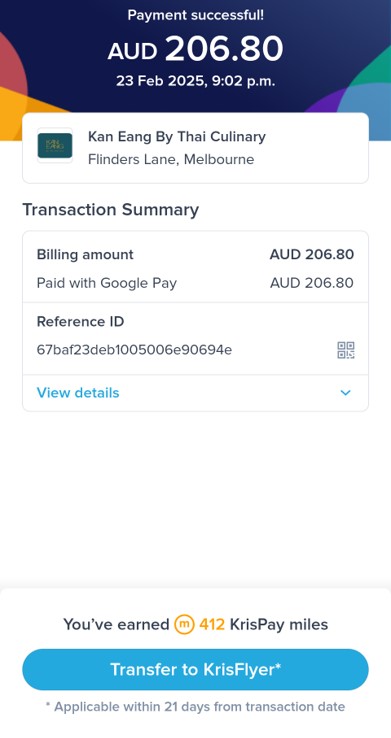

Miles will be credited immediately upon completing the transaction, which makes Kris+ an excellent way of topping up a KrisFlyer balance.

Don’t forget to transfer any KrisPay miles earned to KrisFlyer within 21 days of the transaction, in their entirety. If you wait longer than 21 days, or spend any of the accrued miles, the balance will be stuck in Kris+. Miles in Kris+ expire after six months, and can only be spent at a rate of 100 miles = S$1.

A big “Transfer to KrisFlyer” button appears after every transaction. Alternatively, you can turn on the new auto-transfer feature, which will automatically deposit any miles earned from Kris+ into your KrisFlyer account.

What card should I use with Kris+?

In general, Kris+ retains the MCC of the underlying merchant (though there are some exceptions, most notably for travel agencies), so you can use whatever card you’d normally use for that particular merchant.

When in doubt, the following cards are the safest to use with Kris+, as they earn 3-4 mpd regardless of Kris+ merchant.

| 💳 Best Cards for Kris+ (All Categories) | ||

| Card | Earn Rate | Remarks |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max. S$1K per c. month |

Citi Rewards + Amaze Citi Rewards + AmazeApply |

4 mpd | A 1% admin fee applies if the payment is in SGD. Max. S$1K per s. month. No bonuses if you use the Citi Rewards Card alone |

KrisFlyer UOB Card KrisFlyer UOB CardApply |

3 mpd | No cap |

However, there are also other cards you can use for dining or retail that will earn up to 4 mpd, such as the HSBC Revolution or UOB Lady’s Cards. Refer to the post below for more details.

Conclusion

For the month of August 2025, Kris+ will be offering a flat 6 mpd at 26 dining and retail merchants across Singapore. This is further stackable with up to 4 mpd from the right credit card, for a total of 10 mpd.

You can also purchase vouchers during this period to lock in the miles first, and spend the vouchers later.

UOB Lady’s Solitaire

UOB Lady’s Solitaire UOB Lady’s Card

UOB Lady’s Card

UOB One

UOB One

AMEX Platinum Charge

AMEX Platinum Charge