2026 is here, which means it’s time to unveil The MileLion’s 2026 Credit Card Strategy, my blueprint for earning miles on a day-to-day basis.

Last year was full of changes—some good, some bad. Popular cards like the DBS Woman’s World Card and UOB Lady’s Solitaire cut their bonus caps. The UOB Preferred Platinum Visa and UOB Visa Signature added annoying sub-categories. But there were bright spots too, like the HSBC Revolution’s revival, the launch of the Maybank XL Rewards, and the just-extended 6 mpd promo for the OCBC Rewards Card.

If 2025 went by too quickly for you, I’ve been tracking all the nerfs and buffs on this calendar. You can also find them in the expandable box below (fair warning: it’s a long list!).

2025's Nerfs and Buffs

❓ 2025’s Nerfs and Buffs

| 💳 2026 Credit Card Strategy |

| Abbreviations: c. month = calendar month, s. month = statement month, m. year = membership year |

What’s changed since the last edition?

Here’s a summary of the key updates since I last published this guide in September 2025.

- The UOB Preferred Platinum Visa divided its bonus cap into two separate caps of S$600 per calendar month for mobile contactless, and S$600 per calendar month for selected online transactions

- The DBS yuu Card has increased the minimum spend for 10 mpd to S$800 per calendar month, with a new requirement to transact at 4x merchants each month

- Maybank cards no longer reward utility bills

- DBS cards have excluded MCC 6513 (but CardUp has shifted its payments away from this MCC to ensure that cardholders can continue to earn rewards)

- The OCBC Rewards Card extended its 6 mpd promotion for Watsons, Shopee, Lazada, TikTok Shop and Taobao to 31 March 2026

- HealthHub is now confirmed to code as the rewards-ineligible MCC 9399 for most cards with the notable exception of the DBS Woman’s World Card, for whatever reason

Important reminders

Before we talk about specific cards, here are a few important points to make.

Not a comprehensive listing

First, this article is not intended to be a comprehensive listing of the best cards for each category. There are other cards that could work just as well, so please don’t flood the comments with “why not Card X for category Y?”

Remember, the idea here is to present a strategy rather than a compendium. If you’re interested in a comprehensive listing of the best cards for a given category, you should instead refer to the articles below.

Don’t forget sign-up bonuses

Second, this article doesn’t take into account ongoing sign-up bonuses.

These are opportunities for new cardholders to earn a lump sum of miles by spending a minimum amount within a certain period following approval. You should absolutely try to take advantage of these first, because the effective earn rate (in terms of miles awarded per dollar spent) will be superior to many of the cards in this post.

I publish a monthly article that covers all the sign-up bonuses in detail, and you can also bookmark my Welcome Offers page to keep tabs on the latest promotions.

Categories can overlap

Third, categories can overlap or be subsets of each other, so don’t think about them too rigidly.

For example, a card which earns bonuses on contactless payments can be used at a restaurant, department store, supermarket, or anywhere that contactless payments are accepted. Likewise, if a card earns bonuses on foreign currency spend, it doesn’t matter whether that spend is dining, shopping or travel-related.

Check the definitions

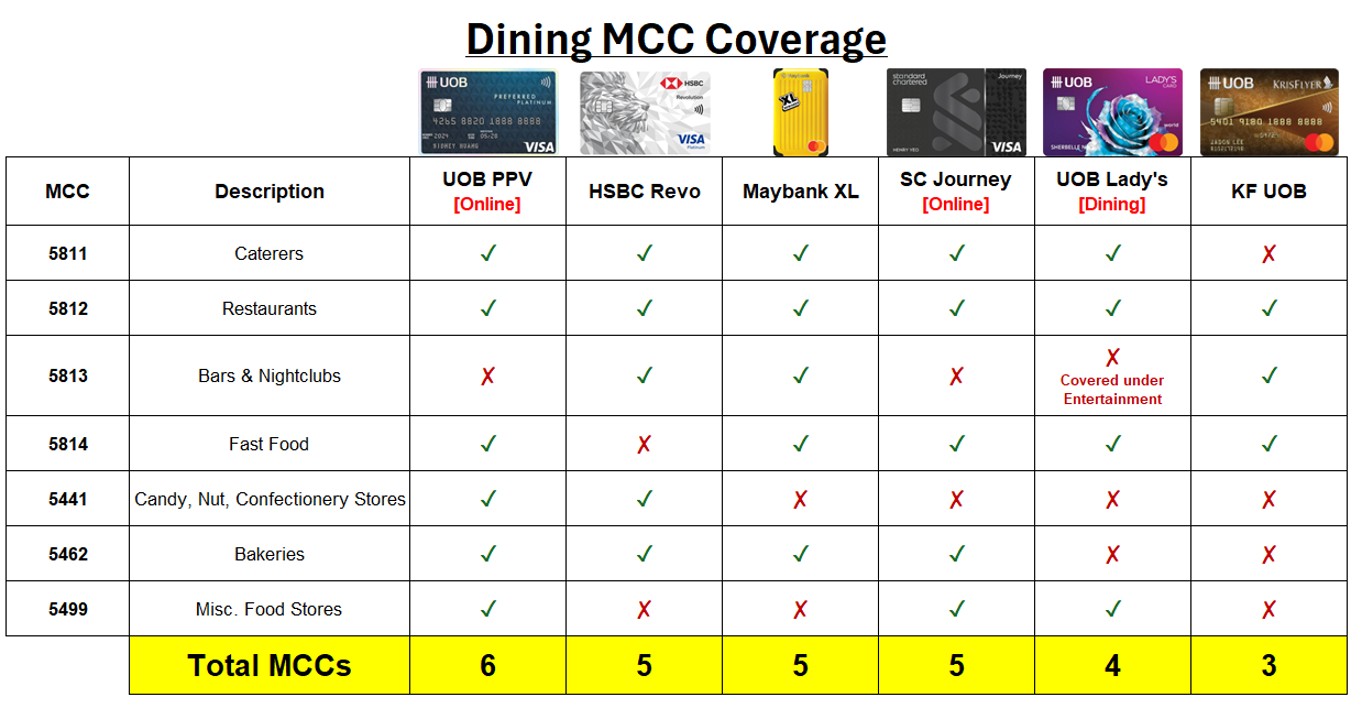

Fourth, different cards may define the same category differently. What counts as dining for HSBC may be different from UOB!

Always refer to the T&Cs for the exact list of eligible MCCs, and if you need to check the MCC of a given merchant, use the methods below.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

| Note: “Ease of use” and “reliability” are all relative. HeyMax already provides a solid baseline for reliability, and the DBS digibot is still simple enough to use, despite requiring more steps than the other two methods. | ||

Calendar month versus statement month

Your card’s bonus cap may be based on the calendar month or statement month.

- Calendar month is straightforward (e.g. 1-31 January)

- Statement month varies from person to person. You can check it by looking at the statement date on your eStatement. This is the last day of the statement month. For example, if the last day of the statement month is the 12th, the statement month runs from the 13th of this month to the 12th of the following month

It may be possible to call up the bank and request for your statement month to be shifted to a date that more closely aligns with the calendar month. That’s what I’ve done with my UOB Visa Signature, and now its statement date matches the calendar month (disclaimer: banks have a certain quota per date, so it might not be possible to shift yours).

Which cards am I using for 2026?

Here’s a summary of the cards that I’ll be using the most in 2026, which is basically unchanged from late last year.

| Card | Categories |

Citi Rewards Card Citi Rewards CardApply |

4 mpd |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd |

DBS yuu AMEX/Visa DBS yuu AMEX/VisaApply |

10 mpd |

HSBC Revolution HSBC RevolutionApply |

4 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd

2.8 mpd |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd

4 mpd |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd |

OCBC Rewards Card OCBC Rewards CardApply |

6 mpd |

UOB Lady’s Solitaire UOB Lady’s SolitaireDining Fashion Apply |

4 mpd |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd |

| 👍 Extra 2 mpd with UOB Lady’s Cards |

| UOB Lady’s Card or UOB Lady’s Solitaire Cardholders can earn an extra 2 mpd (6 mpd total) by opening a UOB Lady’s Savings Account and depositing S$10,000. |

I realise that 12 cards may seem like a lot to keep track of, but once you learn the general heuristics, it’s really not as complicated as it seems (honest!).

Also, if your monthly spending is more modest, it’s highly unlikely you’ll need all the cards shown above. Those spending <S$3,800 per month could use the following “minipack” to earn 4 mpd on almost everything, without the need to memorise specific categories.

| 💳 “Minipack” For Smaller Spenders |

||

| Card | Spend | Remarks |

Citi Rewards Citi RewardsApply |

S$1,000 | Online spend ex. travel |

DBS Woman’s World Card DBS Woman’s World CardApply |

S$1,000 |

Online spend |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

S$600* | Mobile contactless |

UOB Visa Signature UOB Visa SignatureApply |

S$1,200^ | Contactless spend (min. S$1,000 per s. month) |

| *Separate S$600 bonus cap for selected online transactions including dining, groceries, entertainment and shopping ^Separate S$1,200 bonus cap for FCY transactions, with min. spend S$1,000 per s. month |

||

You will miss out on some higher-earning opportunities — like 6 mpd with the OCBC Rewards or 10 mpd with the DBS yuu Card — but this keeps things extremely straightforward.

What card for which category?

Contactless Payments

| Card | Earn Rate | Remarks |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | Max S$600 per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd | Min S$1K, max S$1.2K per s. month in SGD Review |

A bonus for contactless payments is practically a license to earn 4 mpd everywhere, given how ubiquitous contactless terminals are nowadays.

| ❓Well, not everywhere |

| I shouldn’t have to say this (though based on some angry emails I receive, perhaps I do), but UOB’s standard exclusion list still applies. You won’t earn 4 mpd if you use contactless payments at an educational institution or government office, for instance. |

The UOB Preferred Platinum Visa continues to be the go-to option, with 4 mpd on all mobile contactless transactions. Simply add it to your Apple, Google or Samsung Pay account and tap your phone or watch in-store to pay.

The unfortunate thing is that the bonus cap for mobile contactless has been cut from S$1,110 to S$600 per calendar month. If you want to continue getting the most out of this card, you must utilise its lesser-known bonus category: 4 mpd for online food delivery, groceries, entertainment and shopping.

It doesn’t help that the main alternative, the UOB Visa Signature, has also seen a nerf of its own. The bonus cap for contactless has been cut from S$2,000 to S$1,200 per statement month, with the S$1,000 minimum spend still in place.

Do note that each card defines contactless spending slightly differently. You will not earn any bonuses if you tap the physical UOB Preferred Platinum Visa card!

|

|

|

| UOB PPV | UOB VS | |

| ✅ | ✅ | |

|

❌ | ❌ |

| ✅ | ✅ | |

| ✅ | ✅ | |

Tapping physical card Tapping physical card |

❌ | ✅ |

| ❓ What about in-app or online payments? |

|

In-app or online payments are not considered contactless payments. However, they may earn bonuses on the UOB Preferred Platinum Visa if the MCC matches the online bonus whitelist. Contactless payments in this context refer to in-store transactions only. Simple rule: if you hear a beep when you pay, it’s contactless. |

Since the bonus caps for contactless spending have effectively been halved, it’s important to be familiar with ways of turning offline spend into online, in case you need to spend in-store and have busted the caps already.

Online Transactions

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Excludes travel. Max S$1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1K per c. month Review |

Like contactless payments, online transactions are another big catch-all category.

Both the Citi Rewards and DBS Woman’s World Card earn 4 mpd on online transactions, so long as it doesn’t fall into:

- the bank’s general list of exclusions, or

- in the case of the Citi Rewards

- travel-related transactions such as airlines, cruises, hotels, rental cars and travel agencies

- in-app mobile wallet payments (e.g. Deliveroo + Citi Rewards = 4 mpd, Deliveroo + Google Pay (using Citi Rewards) = 0.4 mpd)

| ❓ Blacklist vs Whitelist |

|

The HSBC Revolution, Maybank XL Rewards or UOB Preferred Platinum Visa can also earn 4 mpd for certain online transactions, but exercise caution because these cards follow a “whitelist” approach: a given online transaction doesn’t earn 4 mpd unless its MCC falls within the inclusion list. Contrast this with the Citi Rewards and DBS Woman’s World Card, which follow a “blacklist” approach: a given online transaction will earn 4 mpd unless its MCC falls within the exclusion list. If the whole concept of whitelist and blacklist confuses you, refer to this post. |

In other words, both the Citi Rewards and DBS Woman’s World Card would be well-suited to cover everyday transactions like:

- Food delivery

- Ride-hailing

- Movie tickets

- Google Play or Apple App Store purchases

- Netflix, Spotify and other streaming subscriptions

- E-commerce sites like Amazon, Lazada, Shopee etc.

- (WWMC only) Buying airline tickets, cruises, prepaid hotels or activities & attraction bookings with Klook or Pelago

If I had to choose between the two, I’d lean in the direction of the Citi Rewards Card, simply because its points have a longer validity (up to 5 years, versus 1 year for the WWMC) and more transfer partners (11, versus 4 for the WWMC). However, it does have an annoying exclusion for travel, so that’s something to consider too.

For spending specifically on Shopee, Lazada, Taobao or TikTok Shop, however, I’d bring in the OCBC Rewards Card to take advantage of its 6 mpd promo, available till 31 March 2026. This is capped at S$1,000 per calendar month.

HeyMax

| Card | Earn Rate | Remarks |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$750 per c. month, with Fashion as bonus category Review |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | Max S$600 per c. month Review |

HeyMax, better known for its MCC lookup tool, also sells vouchers for numerous merchants, and all purchases will code as MCC 5311 Department Stores.

|

|

| Get 200 Max Miles when you sign up for a HeyMax account and complete one transaction | |

| Sign up here |

|

|

|

Therefore, whether you’re buying electronics or furniture, booking activities, taking a Grab or gojek, ordering food delivery, buying eSIMs or shopping online, you can use HeyMax to change the MCC to 5311.

Buying HeyMax vouchers also helps manage the annoying S$600/S$750 bonus sub-caps on the UOB Preferred Platinum Visa/UOB Lady’s Solitaire (I’ve switched one of my bonus categories to Fashion, which covers 5311), because it’s much easier to buy vouchers in exact denominations to hit the caps, rather than spending “in the wild”.

Of course, you could just as well use the HSBC Revolution or OCBC Rewards here too, but in my case, those bonus caps are usually tied up elsewhere.

Atome

| Card | Earn Rate | Remarks |

Citi Rewards Card Citi Rewards CardApply |

4 mpd | Max S$1K per s. month Review |

DBS Woman’s World Card DBS Woman’s World CardApply |

4 mpd | Max S$1K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

| *Temporary boost till 31 March 2026, after which it reverts to S$1,000 per c. month | ||

BNPL platforms like Atome have their detractors, but I think it’s a great tool for any miles chaser. With Atome, you can:

- Break up transactions into three interest-free monthly payments, stretching your cashflow and better optimising the monthly bonus caps on specialised spending cards

- Enjoy extra discounts at selected merchants

- Convert non-bonused MCCs into bonus-earning MCCs

- Convert ineligible MCCs into reward-earning MCCs (Atome partners with quite a few educational institutions)

- Double dip on credit card miles and Atome+ Points (which can be converted into Max Miles)

Do remember to trigger payments manually a few days before they’re due, as automated recurring payments may not be eligible to earn miles.

Since Atome counts as online spend, you can use both the Citi Rewards Card and DBS Woman’s World Card, in addition to the HSBC Revolution Card.

Since I prefer to save the first two for spending elsewhere, the HSBC Revolution usually hard carries this category. The HSBC Revolution now offers a boosted bonus cap of S$1,500 per month, and HSBC points are arguably the most useful rewards currency in Singapore.

- Conversion fees are waived indefinitely

- Conversions to all but two programmes (Hainan and JAL) are instant

- Rewards points pool across all HSBC cards

- While the minimum conversion block is 10,000 miles, the subsequent block is just two miles (so you could transfer 10,002 or 20,496 miles, for example)

- Even though non-expiring points would be nice, HSBC still offers longer validity than most competing banks at 37 months

- It has 16 airline and four hotel transfer partners, by far the most of any bank in Singapore (but remember, this is not the card to use for KrisFlyer miles, following the transfer ratio devaluation in January 2025)

Dining

| Card | Earn Rate | Remarks |

DBS yuu AMEX DBS yuu AMEXApply |

10 mpd | Foodpanda only. Min. spend & cap of S$800 per c. month. Must spend at 4x participating merchants Review |

DBS yuu Visa DBS yuu VisaApply |

10 mpd | |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | Min. S$500, max S$1K per c. month Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$750 per c. month, with Dining as bonus category Review |

| *Temporary boost till 31 March 2026, after which it reverts to S$1,000 per c. month | ||

The dining category includes both dining at restaurants, as well as ordering through food delivery platforms like Deliveroo, GrabFood and Foodpanda (for which the 10 mpd DBS yuu Card should be the only choice).

Dining is the other bonus category on my UOB Lady’s Solitaire Card. However, the HSBC Revolution’s temporary reintroduction of bonuses for in-person contactless spending makes it an alternative option, along with the Maybank XL Rewards Card.

Do note that there are differences in how all three cards define dining, with the HSBC Revolution notably excluding MCC 5814 (Fast Food). That can lead to a lot of unpleasant gotchas. Even if you don’t care for Burger King, KFC or other junk food, 5814 can be used by non-fast food places like Cafe Nesuto and Baker & Cook. It’s also used by food delivery platforms like Grab and Deliveroo, so be careful!

Foreign Currency (FCY) Spend

| Card | Earn Rate | Remarks |

Amaze + Citi Rewards Amaze + Citi RewardsApply |

4 mpd | Max $1K per s. month Review |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | Min. S$500, max S$1K per c. month Review |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | Min. S$1K, max S$1.2K per s. month on FCY spend Review |

Maybank World Mastercard Maybank World MastercardApply |

3.2 mpd | Min. S$4K per c. month. 2.8 mpd with min. S$800 per c. month. No cap Review |

Assuming I haven’t already burst the bonus cap on the Citi Reward Card, I’ll pair it with Amaze to earn 4 mpd on overseas spending with a ~2% FCY fee.

Otherwise, I’ll use the Maybank XL Rewards Card, which also earns 4 mpd provided the minimum spend of S$500 is met (you can also pair it with Amaze, though this should only be for whitelisted categories like dining, shopping, travel and entertainment).

Next in line is the UOB Visa Signature, though unfortunately the “sweet spot” for spending is now much more narrow, following the introduction of bonus sub-caps. You used to be able to spend between S$1,000 and S$2,000, but now the target range is between S$1,000 and S$1,200, which leaves less room for error.

If I’m making a big ticket purchase and need something without a cap, then I’d use the Maybank World Mastercard for an uncapped 3.2 mpd on FCY spend.

Groceries

| Card | Earn Rate | Remarks |

DBS yuu AMEX DBS yuu AMEXApply |

10 mpd | Giant and Cold Storage. Min. spend & cap of S$800 per c. month. Must spend at 4x participating merchants Review |

DBS yuu Visa DBS yuu VisaApply |

10 mpd |

The DBS yuu Card is the only logical option for grocery spending at Giant or Cold Storage, with its unbeatable 10 mpd (shopping at both also helps rack up two unique merchants towards the four merchant minimum).

For the occasions when I visit NTUC, or buy groceries on Amazon Fresh/RedMart, I simply resort to cards which award bonuses for contactless payments (i.e. UOB Preferred Platinum Visa or UOB Visa Signature) or online transactions (i.e. Citi Rewards, DBS Woman’s World Card).

Petrol

| Card | Earn Rate | Remarks |

Maybank World Mastercard Maybank World MastercardApply |

4 mpd | No cap Review |

For petrol, the best card to use really depends on which chain you frequent the most, because the goal is to stack 4 mpd with the highest discount possible.

In my case, Shell is the most convenient, which means I use the Maybank World Mastercard for an uncapped 4 mpd, with no minimum spend necessary (there’s a further 15% discount from the Corporate Fuel Card). Do note that this only applies to in-person payments made in Singapore, so payment through apps or overseas won’t qualify.

| ❓ Why not the UOB Visa Signature? |

| The UOB Visa Signature also earns 4 mpd for petrol, but I’d prefer to conserve that cap for contactless payments instead since it’s much more flexible. |

However, I’m not very dogmatic about this. I’m just as likely to use Kris+ with the DBS Woman’s World Card when at Esso, which offers an extra 3 mpd on top of the standard 4 mpd reward. Alternatively, if I see a Sinopec then I can just take advantage of the 23+% discount with any 4 mpd card at my disposal.

Public Transport

| Card | Earn Rate | Remarks |

DBS yuu AMEX DBS yuu AMEXApply |

10 mpd | Min. spend & cap of S$800 per c. month. Must spend at 4x participating merchants Review |

DBS yuu Visa DBS yuu VisaApply |

10 mpd | |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | Max S$600 per c. month, must use mobile payments Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd | Min S$1K, max S$1.2K per s. month on contactless & petrol Review |

SimplyGo is one of the easiest ways of clocking one merchant towards the DBS yuu Card’s new four merchant minimum, and the fact that you can earn 10 mpd doesn’t hurt either.

Alternatively, if I need to conserve my yuu cap for elsewhere, I could use the UOB Preferred Platinum Visa and UOB Visa Signature instead, since they now recognise SimplyGo bus and MRT rides as contactless spend.

Travel

| Card | Earn Rate | Remarks |

Maybank XL Rewards Maybank XL RewardsApply |

4 mpd | Min. S$500, max S$1K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1.5K per c. month* Review |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd | SIA & Scoot. No cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | Min. S$800 per c. month, capped at S$10K Review |

| *Temporary boost till 31 March 2026, after which it reverts to S$1,000 per c. month |

||

For air tickets, the Maybank XL Rewards and HSBC Revolution both earn 4 mpd, though the latter is only an option until 31 March 2026.

However, given the monthly caps of S$1,000 and S$1,500 respectively — and the fact that I might use them for other categories of spending — I need some uncapped options too. That comes in the form of the KrisFlyer UOB Credit Card (uncapped 3 mpd for SIA and Scoot) and Maybank Horizon Visa Signature (2.8 mpd on air tickets in general, with a S$10,000 monthly cap).

For hotels, the Maybank XL Rewards and HSBC Revolution also work, though if the transaction is in FCY I can also bring in the cards from the FCY section.

yuu Merchants

| Card | Earn Rate | Remarks |

DBS yuu AMEX DBS yuu AMEXApply |

10 mpd | Min. spend & cap of S$800 per c. month. Must spend at 4x participating merchants Review |

DBS yuu Visa DBS yuu VisaApply |

If you’re spending at a yuu merchant, there is absolutely no question about which card you should use: the DBS yuu AMEX or DBS yuu Visa, for 10 mpd.

| Participating Merchant | Consists Of |

| 🏪 7-Eleven |

|

| 🍵 CHAGEE |

|

| ⚡Charge+ Visa only |

|

| 🛒 Cold Storage |

|

| 🍽️ foodpanda |

|

| 🛒 Giant |

|

| 💊 Guardian |

|

| 🚕 Gojek |

|

| 📱 Singtel |

|

| 🚆 SimplyGo* |

|

| *SimplyGo is not a yuu merchant per se, but is still eligible for the bonus earn rate |

|

The only speed bump here is the minimum spend of S$800 per calendar month (which is also the cap), but between groceries, food delivery, pharmacy items and ride-hailing, it’s doable for me.

Since this gets asked a lot, I want to clarify that the minimum spend need not be on yuu merchants alone. However, I find it a waste to spend on non-yuu merchants because you’ll earn just 0.14 mpd, which will drag down your overall earn rate. Even if you’re slightly short of the minimum spend, buying Cold Storage or Giant vouchers would be a better way of making up the balance than non-yuu spend.

What other cards can you consider?

Chocolate Visa Card

Chocolate Visa Card Chocolate Visa Card |

|||

| Apply |

The Chocolate Visa Card was great for a while, but on 1 July 2025 its earn rate was cut to 1 mpd, and a monthly cap of 100 miles added for so-called “bill payments” (which include utilities, insurance, business services, healthcare and government services).

Because of this, the only two scenarios where I could see using the Chocolate Visa Card would be:

- When you’re spending on charitable donations and education, which are not subject to the 100 miles cap for bill payments

- When you’re spending in FCY, and want to minimise transaction costs while still earning rewards (Chocolate has no FCY fees; all transactions are converted to SGD at the prevailing Visa rates)

UOB Lady’s Card

Depending on who you ask, the UOB Lady’s Card might actually be superior to the UOB Lady’s Solitaire now, because some people find 4 mpd on up to S$1,000 in a single category more useful than 4 mpd on up to S$750 across two categories.

I’ve made the case for and against downgrading in the post below.

StanChart Beyond Card

The StanChart Beyond Card has a hefty S$1,635 annual fee, and if you’ve decided to take the plunge, you’d better start using it religiously.

Not only do you have a hefty minimum spend of S$20,000 to meet for the welcome bonus, this card’s mechanics are structured in a way that the more you spend, the more you get rewarded.

| Regular | Priority Banking | Priority Private | |

| Welcome Offer | 100,000 miles |

||

| Local Earn | 1.5 mpd | 2 mpd | 2 mpd |

| FCY Earn | 3 mpd | 3.5 mpd | 4 mpd |

| FCY Dining | 8 mpd | ||

The local earn rates of 1.5-2 mpd are already good for a general spending card, but what’s even more impressive is the FCY earn rates of 3-4 mpd (and 8 mpd for overseas dining if you’re a Priority Private customer).

StanChart Smart Card

The StanChart Smart Card earns a remarkable uncapped 9.3 mpd on streaming, public transport, electric car charging and fast food, but there’s a big catch here. You need to spend at least S$1,500 per statement month to unlock that rate (7.4 mpd is possible with a minimum spend of S$800).

I don’t know about you, but I would find it exceedingly difficult to spend that much on these categories, though I’m sure there’ll be some who make it work (e.g. a Grab driver with an EV).

General spending cards

I make it a point to avoid general spending cards as much as possible, for the simple reason that there’s no reason to earn 1.2-1.6 mpd when you could be earning 4 mpd.

However, general spending cards can still be part of a sound miles strategy, in situations where:

- There’s a lucrative welcome offer

- You’ve exhausted the bonus caps on higher-earning specialised spending cards

- You have a big-ticket transaction that can’t be split across multiple cards

- There’s a limited-time promotion that upsizes the earn rates

- You’re using CardUp or Citi PayAll, which aren’t eligible for bonuses with specialised spending cards

In these situations, it’s all about picking the highest-earning general spending card there is.

Final reminders

Don’t forget Kris+

Whenever you’re at a restaurant, store, spa or hotel, always be sure to check whether they’re a Kris+ merchant, because that’s an easy opportunity to stack a further 0.5-9 mpd on top of your credit card miles.

|

|||

| S$5 for new Kris+ Users | |||

| Get S$5 (in the form of 500 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

I’ve written a separate guide on the best cards to use with Kris+, which can be found below.

Don’t over-optimise

As much as we want to maximise 4 mpd everywhere, is it possible to overdo it?

Definitely. The way I see it, there are two additional considerations:

(1) Conversion Fees

By spreading your cards across multiple banks, you’re collecting different points currencies and will have to pay multiple conversion fees.

However, I’m not too worried about this. Conversion fees are annoying and we try to minimise them where we can, but paying them isn’t the end of the world. In the grand scheme of things, an extra S$25 here and there isn’t going to destroy the overall value proposition of the miles game.

| 💰 Points Conversion Fees by Bank |

||

| Issuer | Per Conversion | Annual Option |

|

Free | N/A |

|

S$30 | N/A |

| S$27.251 | N/A | |

| S$27.252 | S$43.603 | |

| Free | N/A | |

| S$27.25 | N/A | |

| S$25 | N/A | |

| S$27.25 | N/A | |

| S$274 | S$505 | |

| 1. Waived for Citi ULTIMA Cardholders 2. Waived for DBS Insignia Cardholders 3. Automatic conversions in blocks of 500 DBS points (1,000 miles) each quarter. Additional ad-hoc redemptions can be done for free 4. Waived for UOB Reserve, UOB Visa Infinite Metal, UOB Visa Infinite and UOB Privilege Banking Cardholders 5. Automatic conversions in blocks of UNI$2,500 (5,000 miles) each month for balances above UNI$15,000. Additional ad-hoc redemptions cost S$25 each |

||

Moreover, it doesn’t necessarily mean more cards = more fees. If you own multiple cards from the same bank, you may still pay only a single conversion fee, provided the points are pooled.

For example, a UOB customer could hold a UOB PRVI Miles, UOB Preferred Platinum Visa, UOB Visa Signature and UOB Lady’s Card, all while paying only a single conversion fee.

(2) Orphan Points

Orphan points are a bigger concern than conversion fees. If you spread yourself too thin, you may end up in a situation where you’re optimising on individual transactions, but not in an overall sense.

To illustrate, suppose I drive infrequently but get a Maybank World Mastercard just so I can earn 4 mpd on petrol. I may be optimising on that particular transaction, but it counts for very little if I end up with a small chunk of TREATS points that I can’t cash out.

All things equal, non-pooling credit card points with larger minimum conversion blocks are more likely to result in orphan miles.

| ✈️ Min. Conversion Blocks for KrisFlyer Miles | ||

| Currency | Points |

Miles |

| AMEX Membership Rewards Pool |

400 (Plat. Charge, Centurion) |

250 |

| 450 (All others) |

||

| BOC Points | 50K | 10K |

| Citi Miles | 10K | 10K |

| Citi ThankYou Points | 25K | 10K |

| DBS Points Pool |

5K | 10K |

| HSBC Points Pool |

35K^ (+7 beyond this) |

10K^ (+2 beyond this) |

| Maybank TREATS Pool |

25K | 10K |

| OCBC$ Pool |

25K | 10K |

| OCBC 90°N Miles Pool |

1K | 1K |

| OCBC VOYAGE Miles | 1 | 1 |

| SC 360° Rewards Points Pool* |

25K (Beyond, Visa Infinite & Journey) |

10K |

| 34.5K (All other cards) |

||

| UOB UNI$ Pool |

5K | 10K |

| *Points earned on Visa Infinite/Journey cards cannot be pooled with points earned on other StanChart cards |

||

tl;dr: Optimisation is good, but you need to look at both the micro and macro picture. If you don’t spend a significant amount on a particular category, then consider using a blacklist card like the Citi Rewards or UOB Preferred Platinum Visa, or even a general spending card instead.

Quality vs quantity of points

Not all credit card points are made equal. They differ in terms of:

In other words, two cards could offer 4 mpd, but one card’s 4 mpd might be more valuable than the other. I personally consider AMEX Membership Rewards points, Citi Miles/ThankYou points and HSBC points to be the three most valuable rewards currencies in Singapore.

Because of this, I’d be more inclined to max out the online bonus cap on my Citi Rewards Card first, before switching over to my DBS Woman’s World Card.

Conclusion

There’ll be one dozen credit cards in my regular rotation for 2026, but again, most people won’t need so many. A simple four-card combo of the Citi Rewards, DBS Woman’s World Card, UOB Preferred Platinum Visa and UOB Visa Signature will be enough for a miles game newbie to earn 4 mpd on most transactions- though not as much as before thanks to the new sub-caps for UOB cards.

The other cards come in when you:

- have specific use cases (e.g. Maybank World Mastercard for overseas education spend)

- already burst the monthly bonus caps on those four cards

- want to take advantage of “beyond 4 mpd” opportunities (e.g. UOB Lady’s Card + Lady’s Savings Account, OCBC Rewards for Shopee & Lazada, DBS yuu for yuu merchants)

I’m sure there’ll be further changes to come in 2026, and when that happens we’ll need to reshuffle our deck accordingly. I’ll be aiming to update this every quarter, so stay tuned.

How’s your card strategy looking for 2026?

excellent comprehensive article

2026 likely to be the same.

citi rewards (ms and visa) – online, transport, and shopping

citi pm – agoda

ocbc rewards – stop using for now as it will be come orphan miles.

uob ppv and vs – general spending on contactless and fcy but need to be care on vs.

uob krisflyer – kris+, sq, scoot and krishop

uob ladys solitaire dining and travel.

amaze + citi rewards ms if exceed $50 for FCY – jb shopping or use ppv or cash.

citi prestige if I max all above.

Is heymax considered online purchase too, that it can be paired with wwmc?